Calculating bond yields can be a tricky task, but thankfully, Google Sheets has a built-in function that makes it a lot easier. In this guide, we’ll explain how to use the YIELD function in Google Sheets with a real-world example, breaking down each step to help you understand the process.

If you’re ready to learn how to use the YIELD function to calculate bond yields in Google Sheets, let’s dive in!

Why Use the YIELD Function?

The YIELD function in Google Sheets is specifically designed to calculate the annual yield of a bond. This is particularly useful for investors who want to know the return on their investments based on the bond price, coupon rate, and other parameters. The beauty of this function is that it automatically performs complex calculations, giving you the bond’s yield in just a few clicks.

Step 1: Setting Up the Data

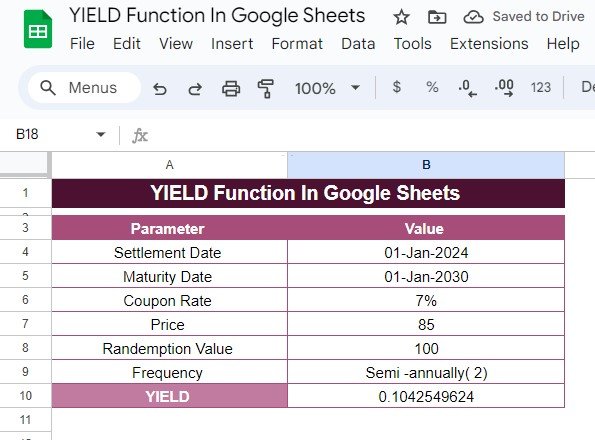

Before we jump into the formula, let’s first set up the data in Google Sheets. Here’s the data we’ll be working with, which you can input into your spreadsheet:

With this data ready in your sheet, the next step is to apply the YIELD functions

to calculate the bond’s yield.

Step 2: Using the YIELD Function

To calculate the bond yield using this data, we will use the following formula in Google Sheets:

=YIELD(B4, B5, B6, B7, B8, 2, 1)

Let’s break down the formula step by step:

- B4: Settlement Date (01-Jan-2024) – This is the date on which the bond was purchased.

- B5: Maturity Date (01-Jan-2030) – This is the date when the bond matures.

- B6: Coupon Rate (7%) – This is the annual interest rate the bond pays.

- B7: Price (85) – This is the current price of the bond, expressed as a percentage of the face value.

- B8: Redemption Value (100) – This is the face value of the bond or the amount to be paid back at maturity.

- 2: Frequency – The number of coupon payments per year. Since this bond pays semi-annually, the frequency is 2.

- 1: Basis – The day count convention used. In this case, 1 stands for “actual/actual” which is commonly used in bond calculations.

Step 3: The Result

After entering the formula, Google Sheets will instantly calculate the bond’s yield. The output is:

This means the annual yield of the bond is approximately 10.43%. This is a valuable piece of information for investors who want to know how much return they can expect from holding the bond until maturity.

Why Is This Important?

The YIELD function is an essential tool for anyone dealing with bonds or fixed-income investments. It allows you to determine the return on your investment based on various factors such as price, coupon rate, and frequency of payments. With this function, you can make better-informed decisions on whether a bond is worth investing in, especially when comparing it to other investment opportunities.

Wrapping Up

Using the YIELD function in Google Sheets is a simple yet powerful way to calculate bond yields. By entering a few parameters, you can quickly determine the return on a bond investment. This can save you a lot of time and effort in performing manual calculations.

Visit our YouTube channel to learn step-by-step video tutorials

Youtube.com/@NeotechNavigators