Calculate GST Tax in Google Sheets taxes can be a daunting task, especially when you’re dealing with complex datasets. Fortunately, Google Sheets offers a simple and efficient way to calculate GST (Goods and Services Tax), allowing you to quickly assess the tax on your products. In this blog post, we’ll walk through a practical example of how to calculate GST in Google Sheets, making your tax calculations both accurate and easy to manage.

Why Use for Calculate GST Tax in Google Sheets?

Google Sheets is a powerful tool for performing calculations, including tax-related ones like GST. Not only is it accessible from anywhere, but it’s also highly customizable. This allows you to create a tailored solution for your business needs, whether you’re tracking a few products or managing a larger inventory.

By the end of this guide, you’ll know how to calculate GST at 18% for various products, using simple formulas in Google Sheets.

Step-by-Step Example: Calculating GST in Google Sheets

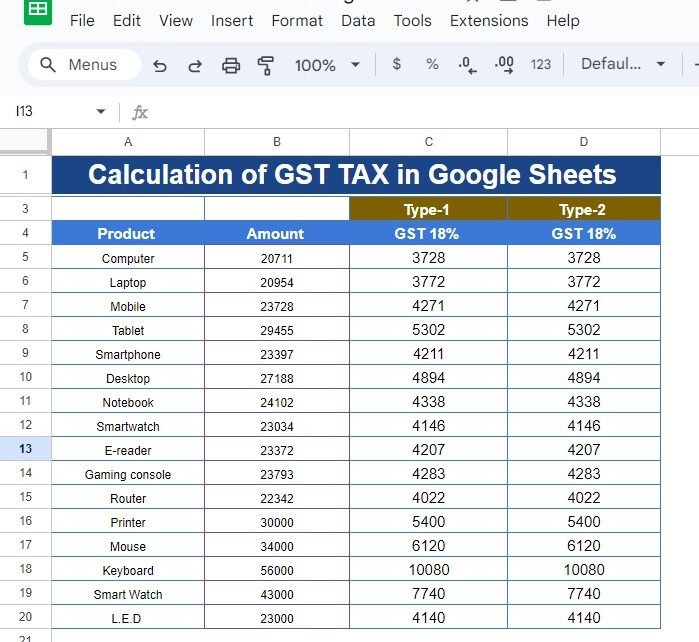

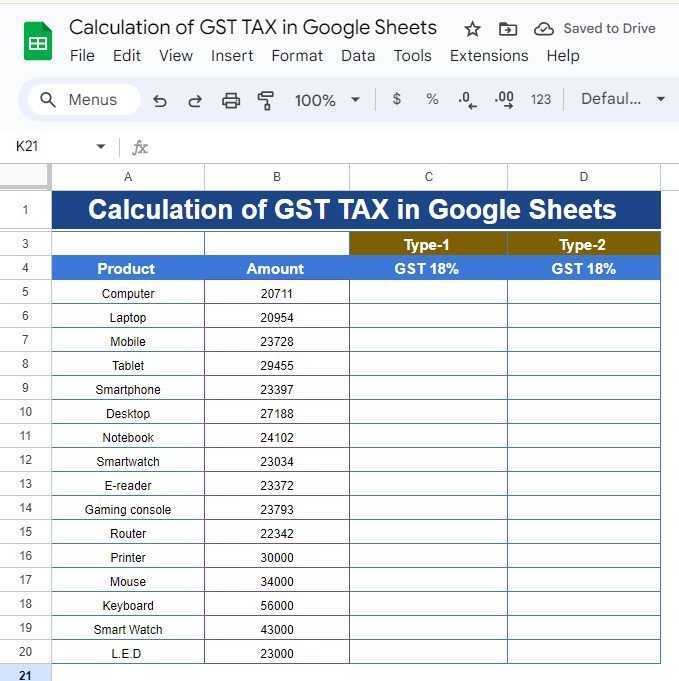

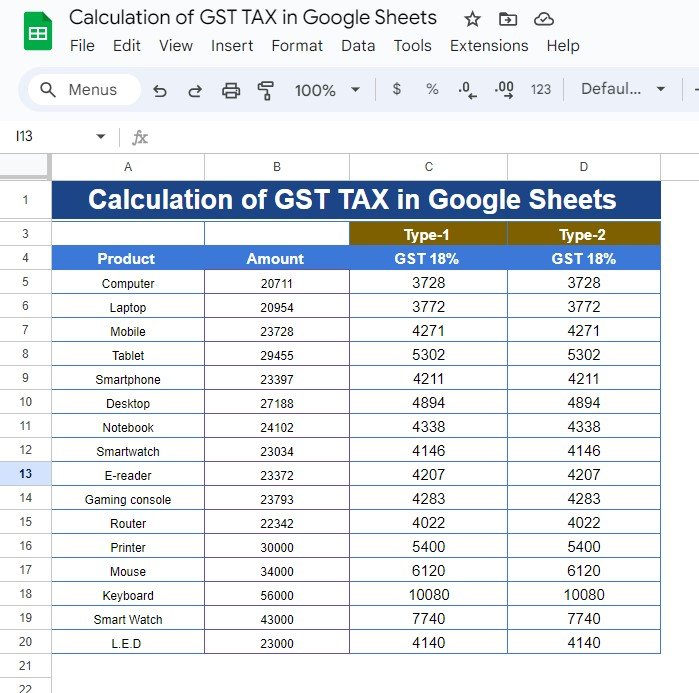

Let’s say you have a list of products and their amounts, and you want to calculate the GST (18%) for each. Here’s the data we’ll be working with:

Now, let’s calculate the GST for each of these products.

The Formula: How Does It Work?

To calculate GST (18%) on the given amounts, we’ll use two different approaches in Google Sheets:

Method 1 (Multiplying by 0.18):

=B5*0.18

This formula multiplies the amount in cell B5 by 0.18 (which represents 18% GST). The result will give you the GST value for that product.

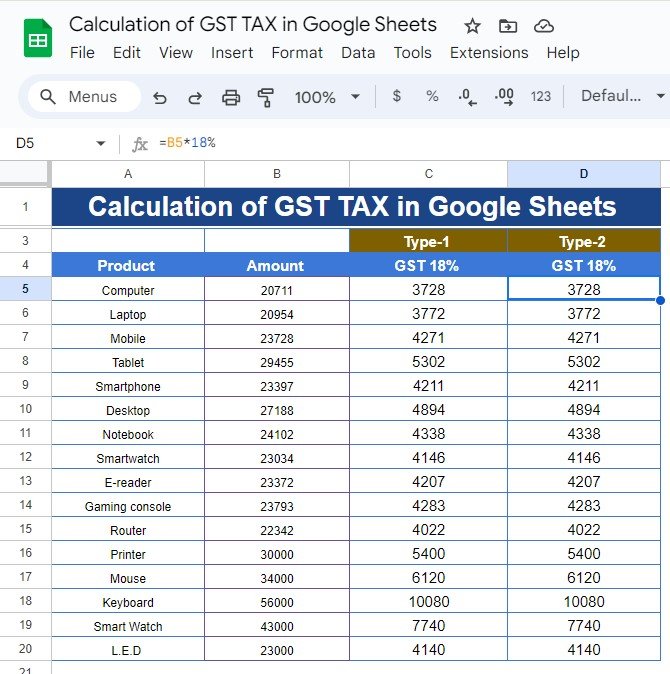

Method 2 (Using Percentage Format):

=B5*18%

This alternative formula does the same thing but uses the percentage format (18%) directly. It’s just a different way of writing the formula, and both methods will yield the same result.

Example Output

Using the formulas above, here’s the output you’ll get:

Both methods provide the same result, so you can choose whichever formula you prefer.

Understanding the Results

In the example above, you can see the calculated GST (18%) for each product. For instance, the GST on a Computer priced at 20,711 is 3,728. This means you need to add 3,728 as tax to the base amount, which brings the total cost (with GST included) to 24,439.

This approach simplifies the GST calculation process, allowing you to quickly apply tax to any product list. Plus, since the formulas are dynamic, if the product price changes, the GST amount will automatically update.

Why This Method Works

There are several reasons why calculating GST in Google Sheets is both practical and efficient:

- Automation: Once you set up your formulas, the calculations happen automatically, saving you time and effort.

- Flexibility: You can easily adjust the formulas to apply different tax rates or accommodate various datasets.

- Accuracy: Google Sheets performs the calculations precisely, reducing the risk of human error.

Conclusion

With just a few simple formulas, you can efficiently calculate GST in Google Sheets, streamlining your tax calculations and ensuring accuracy. Whether you’re managing a small business or handling your personal finances, this method makes it easy to apply tax rates and keep track of your expenses.

Visit our YouTube channel to learn step-by-step video tutorials

Youtube.com/@NeotechNavigators

View this post on Instagram