Managing a budget effectively is one of the most important tasks for both individuals and organizations. Whether you are handling personal finances, planning business expenses, or tracking project costs, a well-structured budgeting system ensures you never lose control over your money. While traditional budgeting methods often feel overwhelming, a Budget Planning Calendar in Google Sheets simplifies the entire process.

This ready-to-use tool combines the power of calendar-based scheduling with structured financial planning, helping you keep track of income, expenses, and financial events in one place. In this article, we will explore the features, benefits, use cases, best practices, and frequently asked questions about this template. By the end, you will see why Google Sheets is the perfect platform for budget planning and how this calendar can transform the way you handle money.

Click to Purchases Budget Planning Calendar in Google Sheets

What Is a Budget Planning Calendar in Google Sheets?

A Budget Planning Calendar in Google Sheets is a pre-designed template that allows you to plan, schedule, and monitor financial activities. Instead of juggling multiple spreadsheets or relying on separate tools, this calendar integrates event management and budget tracking seamlessly.

It is not just a regular calendar—it is an interactive system that:

-

Displays your financial events in annual, monthly, and daily views.

-

Helps you schedule expenses, bill payments, and financial goals.

-

Tracks budget-related activities with details like date, time, and location.

-

Allows collaboration with team members, family, or stakeholders.

Because it is built in Google Sheets, it offers real-time collaboration, cloud accessibility, and flexibility that traditional spreadsheets or offline tools cannot match.

Key Features of the Budget Planning Calendar in Google Sheets

This template is designed to make financial planning easy and organized. It comes with five powerful worksheets, each serving a unique purpose.

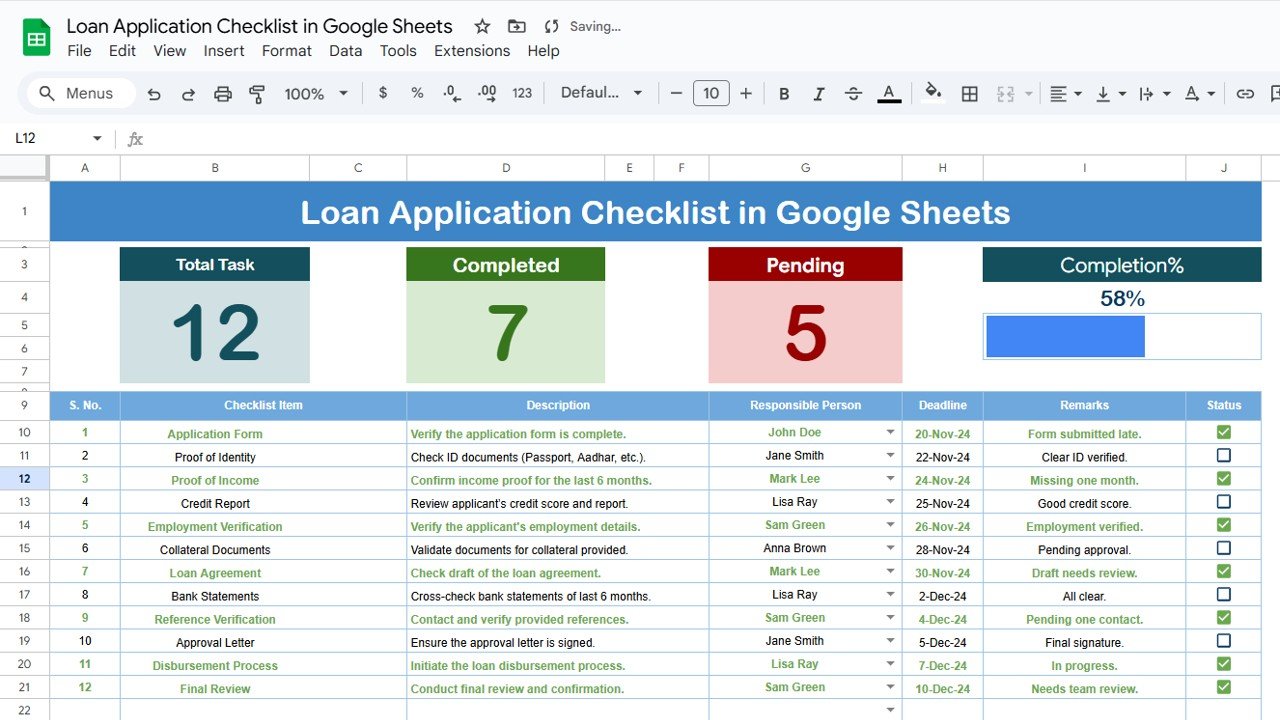

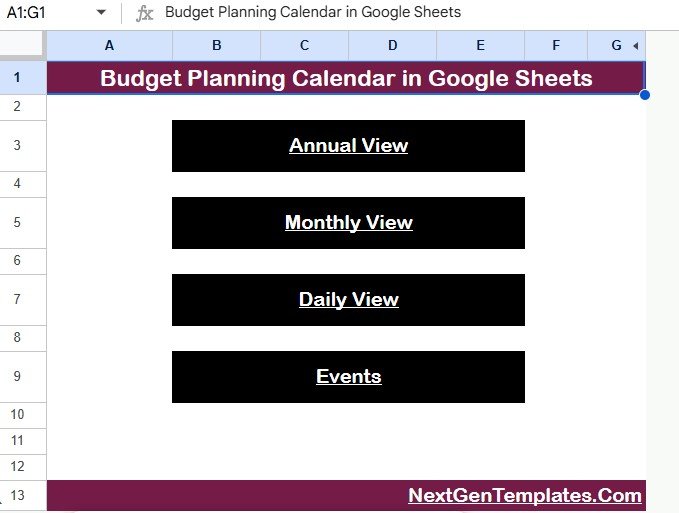

1. Home Sheet Tab

The Home sheet works as the central dashboard of the template. It acts as an index page, giving you quick navigation to other sheets with the help of interactive buttons.

-

Buttons Available:

-

Annual View

-

Monthly View

-

Daily View

-

Events

-

-

This design eliminates the hassle of scrolling or searching manually. Instead, you can jump directly to the section you need.

2. Annual View Sheet Tab

The Annual View displays all 12 months of the year in a clean calendar format.

-

It comes with a control panel where you can:

-

Select the Year.

-

Change the starting month of the calendar.

-

Adjust the starting day of the week (Sunday or Monday).

-

-

This flexibility helps users align the calendar with their financial year or personal preferences.

Example: Businesses that follow an April-to-March fiscal year can adjust the starting month accordingly.

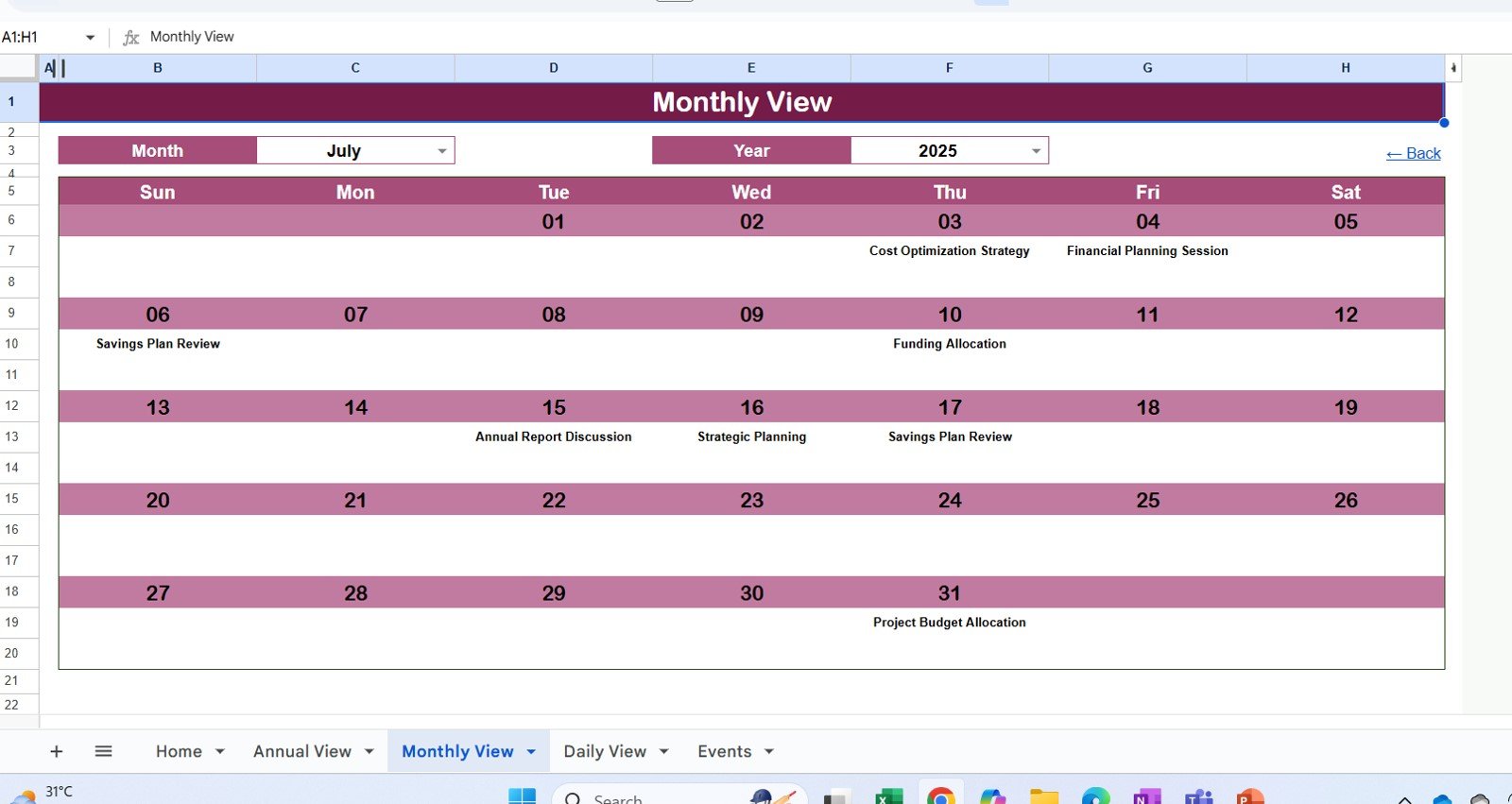

3. Monthly View Sheet Tab

The Monthly View provides a focused look at one month at a time.

-

Users can select Month and Year from dropdown menus.

-

It automatically shows events for the selected month.

-

If there is more than one event on the same date, it displays “more than 1…” as an indicator, allowing you to check the detailed event list later.

This sheet is particularly useful for reviewing recurring expenses like rent, utility bills, or subscription renewals.

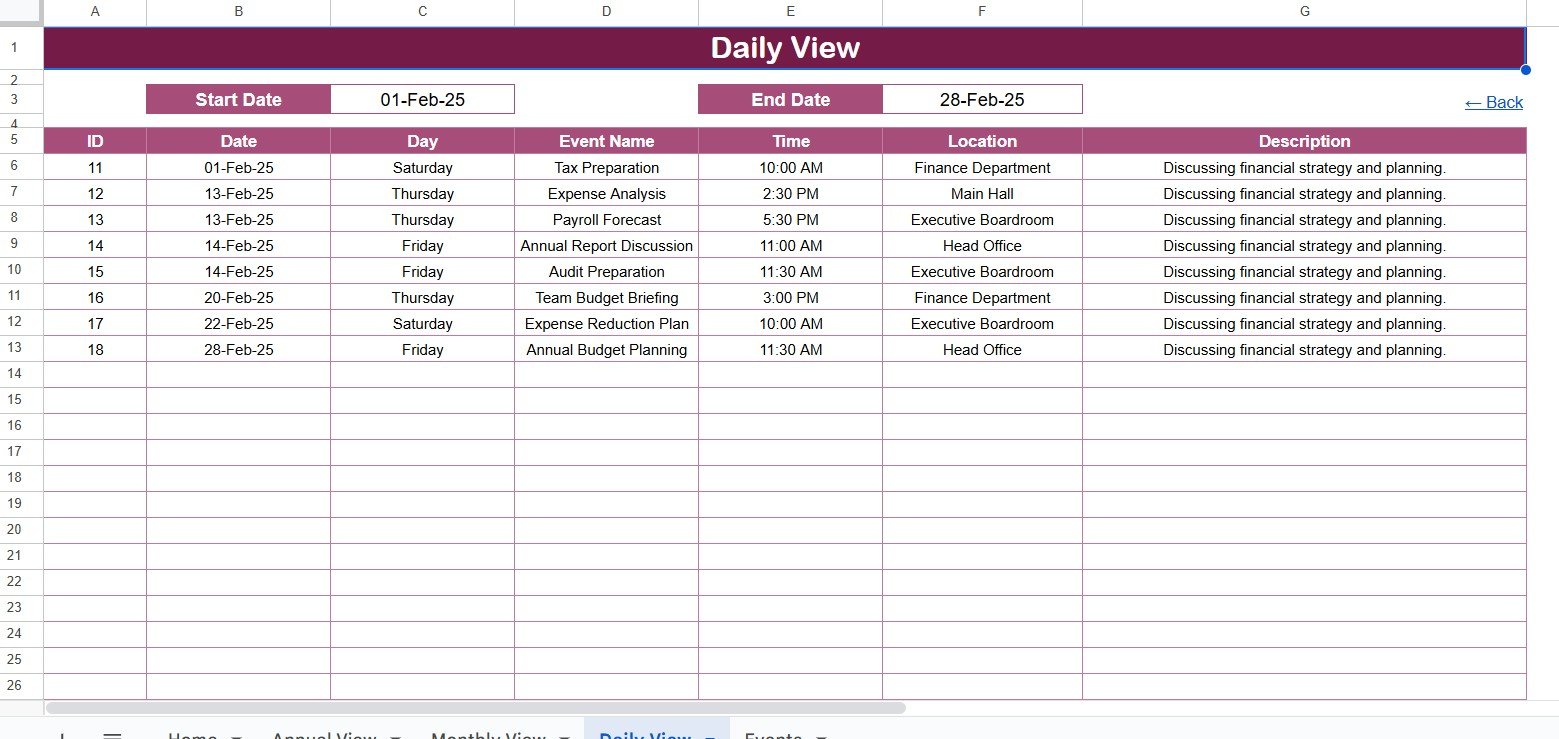

4. Daily View Sheet Tab

The Daily View is designed for micro-level planning.

-

Users can select a date range by entering Start and End Dates.

-

It then shows a list of all financial events happening within that period.

-

Built-in date pickers (calendar icons) make selection easy.

This is perfect for day-to-day budget tracking, such as reviewing daily cash flow or project-specific expenses.

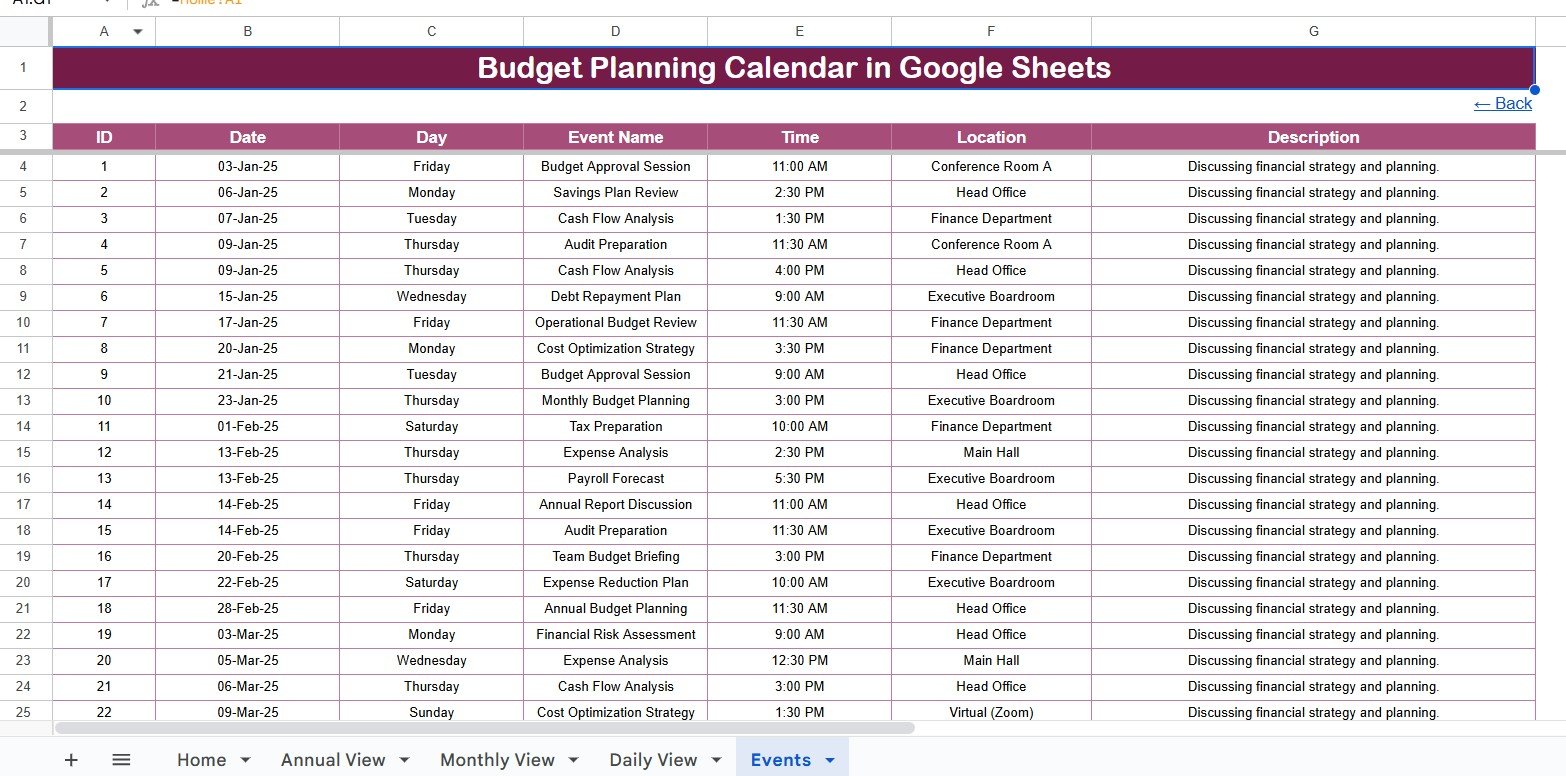

5. Events Sheet Tab

The Events Sheet is the database where all financial records are stored.

-

Columns included:

-

ID (unique identifier)

-

Date

-

Day (auto-generated)

-

Event Name

-

Time

-

Location

-

Description

-

This sheet acts as the backbone of the template. It stores data that automatically feeds into Annual, Monthly, and Daily views, ensuring smooth synchronization across all sheets.

Why Use a Budget Planning Calendar in Google Sheets?

Traditional budgeting methods often involve separate lists, disconnected spreadsheets, or manual notes. This leads to confusion and inefficiency. With a Google Sheets-based calendar, you gain several advantages:

-

Centralized Planning – Keep all budget events in one place.

-

Clarity – Switch between annual, monthly, and daily views for complete visibility.

-

Automation – Events update across views automatically.

-

Collaboration – Share with team members or family to plan finances together.

-

Flexibility – Customize according to your fiscal year, region, or unique requirements.

Advantages of a Budget Planning Calendar in Google Sheets

Here are some key benefits of using this template:

-

📅 Structured Scheduling – Organize all financial activities in calendar form.

-

🔄 Dynamic Updates – Data changes reflect instantly across all views.

-

👥 Collaboration – Real-time access for multiple users.

-

📊 Analysis Ready – Export events to analyze spending patterns.

-

✅ Ease of Use – Prebuilt sheets with dropdowns and controls save time.

-

🌐 Cloud-Based – Accessible from any device, anywhere.

How to Use the Budget Planning Calendar in Google Sheets

Getting started with this template is simple.

-

Open the Home Sheet – Use the buttons to navigate.

-

Enter Events in the Events Sheet – Fill details like date, event name, and description.

-

Review Annual View – Get a bird’s-eye view of all financial events.

-

Switch to Monthly View – Focus on monthly expenses and goals.

-

Check Daily View – Track day-to-day budget execution.

-

Adjust Inputs – Change year, month, or week settings to suit your needs.

Best Practices for the Budget Planning Calendar in Google Sheets

To make the most of this tool, follow these best practices:

-

Keep Event Names Clear – Use short and specific names (e.g., “Rent Payment” instead of “Monthly Apartment Rent”).

-

Update Regularly – Enter new expenses or incomes as soon as they arise.

-

Use Descriptions Wisely – Add context like “Due before 10 AM” or “Client Meeting Budget.”

-

Set a Weekly Review – Check your Daily View weekly to stay on track.

-

Color Code Events – Highlight different categories like bills, savings, or investments.

-

Share with Stakeholders – Allow access to family members or finance teams for transparency.

Who Can Benefit from a Budget Planning Calendar?

This template is versatile and can be used by:

-

Individuals – For managing personal finances and bill tracking.

-

Families – To plan household expenses and savings goals.

-

Small Businesses – For managing operational expenses and revenue schedules.

-

Corporate Teams – To coordinate budgets across departments.

-

Nonprofits – For tracking donations, grants, and spending events.

Conclusion

The Budget Planning Calendar in Google Sheets is more than just a financial tool—it is a complete system for organizing, tracking, and managing money. By combining the familiarity of a calendar with the flexibility of spreadsheets, it provides a practical way to stay in control of your finances.

Whether you are an individual aiming for better savings, a family planning household expenses, or a business managing operational budgets, this tool ensures you stay prepared. With real-time collaboration, structured views, and automated updates, it makes budgeting efficient, transparent, and stress-free.

Click to Purchases Budget Planning Calendar in Google Sheets

Frequently Asked Questions (FAQs)

1. How do I add a new event in the Budget Planning Calendar?

You simply go to the Events Sheet, enter the details like date, name, and description. The event will automatically appear in Annual, Monthly, and Daily views.

2. Can I use this calendar for both personal and business purposes?

Yes. It is flexible enough to handle personal bills, family budgeting, as well as business expense planning.

3. Is the calendar customizable?

Absolutely. You can change year settings, start month, week format, and even add color codes or extra columns as needed.

4. Can I collaborate with others on the same calendar?

Yes. Since it is built in Google Sheets, you can share it with family members, colleagues, or team members for real-time updates.

5. Do I need advanced Excel or Google Sheets skills to use this template?

Not at all. The template is designed to be user-friendly, with dropdown menus, navigation buttons, and prebuilt formulas.

6. Can I analyze spending trends using this calendar?

Yes. Since the data is stored in the Events Sheet, you can create pivot tables and charts to analyze income, expenses, or category-wise spending.

7. What is the biggest advantage of using Google Sheets for budgeting?

The main advantage is real-time collaboration and accessibility. Unlike offline tools, you can access it from any device and allow multiple people to update it simultaneously.

Visit our YouTube channel to learn step-by-step video tutorials

Youtube.com/@NeotechNavigators

Click to Purchases Budget Planning Calendar in Google Sheets

Watch the step-by-step video tutorial: