Managing finances effectively often requires Calculate Monthly Loan Payments with PMT Function accurately. One of the most powerful tools for this purpose is the PMT function in Microsoft Excel. This guide will walk you through how to use the PMT function to calculate monthly loan payments, complete with examples, tips, and best practices.

What Is the PMT Function?

The PMT function in Excel calculates the payment for a loan based on constant interest rates and fixed payments. It’s a widely used financial function to determine how much you need to pay monthly to cover your loan over a specified period.

Why Use the PMT Function?

The PMT function simplifies complex loan calculations, saving you time and reducing the chances of errors. Whether you’re planning for a personal loan, a car loan, or a mortgage, this function can quickly provide an accurate monthly payment value.

How to Use the PMT Function

To use the PMT function, you need three primary inputs

- Rate (interest rate per period): This is the annual interest rate divided by 12 for monthly payments.

- Nper (number of periods): This is the total number of payments, calculated by multiplying the loan term (in years) by 12.

- Pv (present value): This is the loan amount or principal.

Syntax of the PMT Function:

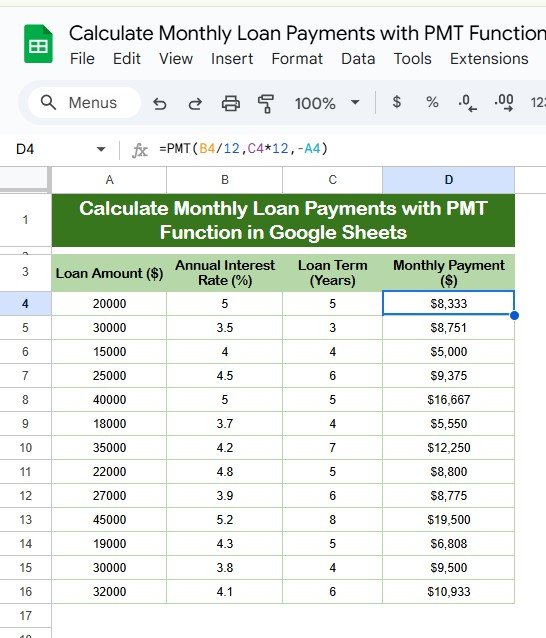

=PMT(rate, nper, pv, [fv], [type])

- Rate: Interest rate for each period.

- Nper: Total number of payments.

- Pv: Present value of the loan (loan amount).

- [Fv]: Future value, optional (defaults to 0).

- [Type]: Payment type, optional (0 for end of period, 1 for beginning).

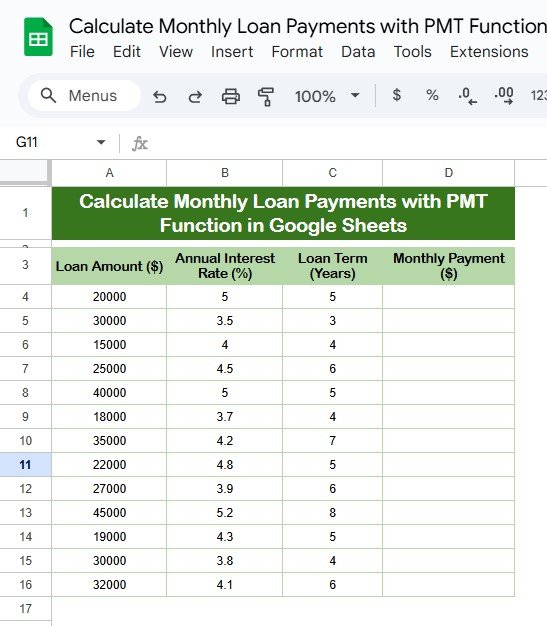

Example: Calculate Monthly Loan Payments with PMT Function

Let’s understand this with a practical example. Below is the data for a loan:

Advantages of Using the PMT Function

- Accuracy in Financial Planning: The PMT function ensures accurate calculations, helping you avoid manual errors.

- Saves Time: Automating loan payment calculations saves hours of manual effort.

- Flexibility: You can modify inputs like interest rate, loan amount, or loan term to simulate different scenarios.

Opportunities for Improvement in Loan Calculations

While the PMT function is powerful, here are some areas where improvements can be made:

- Understanding Compound Interest: Ensure you correctly understand the interest compounding frequency (monthly, annually).

- Accounting for Additional Fees: The PMT function does not include processing fees or other charges; factor these into your calculations separately.

- Comparing Loan Options: Use scenarios with different rates and terms to find the best loan for your needs.

Best Practices for Using the PMT Function

- Use Cell References: Always use cell references instead of hardcoding values in the formula. This makes the calculations dynamic and easier to adjust.

- Label Your Data Clearly: Ensure each cell has a proper label, so you know what value corresponds to which input.

- Test with Different Scenarios: Experiment with varying interest rates, loan terms, and amounts to see how your monthly payments change.

Common Questions About the PMT Function

- Does the PMT Function Account for Taxes?

No, the PMT function only calculates the principal and interest. Taxes and fees must be added separately.

- Can I Use the PMT Function for Quarterly Payments?

Yes, divide the annual interest rate by 4 and multiply the loan term by 4 to adjust for quarterly payments.

- Why Are My PMT Results Negative?

The PMT function returns a negative value because it represents cash outflow. Use the -Pv (negative present value) in the formula for a positive result.

Frequently Asked Questions

Q1: Can I use the PMT function for variable interest rates?

No, the PMT function only works for fixed interest rates. For variable rates, you need a more advanced model.

Q2: What does the type argument in the PMT function do?

The type argument determines whether payments are due at the beginning (1) or the end (0) of each period. Default is 0 (end of the period).

Q3: What happens if I omit the [fv] and [type] arguments?

The [fv] argument defaults to 0, and [type] defaults to 0, meaning payments are calculated assuming the loan is fully paid off at the end of the term.

Conclusion

The PMT function is an indispensable tool for calculating loan payments. By understanding its components and using it effectively, you can streamline your financial planning, compare different loan options, and make well-informed decisions. Whether you’re budgeting for a car, a home, or a personal loan, mastering this function is a step toward financial success.

Visit our YouTube channel to learn step-by-step video tutorials

Youtube.com/@NeotechNavigators

View this post on Instagram