Managing vendor payments is one of the most critical responsibilities for finance and procurement teams. When vendor invoices are tracked manually across emails, spreadsheets, and accounting tools, payment delays increase, overdue amounts rise, and vendor relationships suffer. Because of these challenges, organizations now prefer a centralized and visual system that shows payment status clearly.

A Vendor Payment Dashboard in Google Sheets solves this problem efficiently. It provides real-time visibility into outstanding amounts, paid invoices, overdue risks, vendor performance, departmental spending, and payment efficiency. Since the dashboard is built in Google Sheets, it is easy to use, collaborative, and ready to deploy without expensive software.

In this article, we explain how the Vendor Payment Dashboard in Google Sheets works, its sheet-wise structure, key cards, charts, search functionality, advantages, improvement opportunities, best practices, and frequently asked questions.

What Is a Vendor Payment Dashboard in Google Sheets?

A Vendor Payment Dashboard is a centralized reporting tool that tracks vendor invoices, payments, outstanding balances, overdue risks, and spending trends. It converts raw invoice data into meaningful insights using KPI cards and interactive charts.

Because this dashboard runs in Google Sheets, finance teams gain:

- Real-time updates

- Easy collaboration

- Zero setup cost

- Simple customization

- Instant visual reporting

This dashboard is ideal for accounts payable teams, procurement managers, finance controllers, and business owners.

Why Do Organizations Need a Vendor Payment Dashboard?

Click to Buy Vendor Payment Dashboard in Google Sheets

Vendor payments directly affect cash flow, supplier trust, and operational stability. Without a structured dashboard, teams often face:

- Missed payment deadlines

- High overdue amounts

- Poor vendor visibility

- Weak risk control

- Manual reconciliation issues

A Vendor Payment Dashboard helps organizations:

- Track outstanding and paid invoices clearly

- Reduce overdue risks

- Improve vendor relationships

- Control departmental spending

- Strengthen payment discipline

Key Features of the Vendor Payment Dashboard

This ready-to-use dashboard includes:

- Overview Sheet with KPI cards and summary charts

- Vendor Performance Analysis

- Aging & Risk Analysis

- Department & Buyer Insights

- Payment Method & Process Efficiency

- Smart Search by Keyword and Field Name

Each section plays a specific role in payment control and financial visibility.

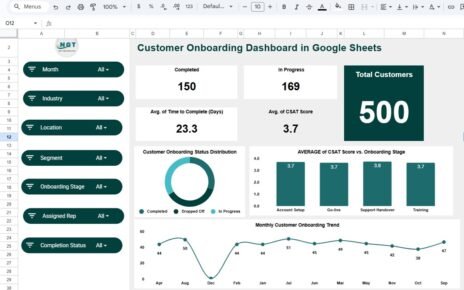

Overview Sheet Tab

Click to Buy Vendor Payment Dashboard in Google Sheets

The Overview sheet provides a high-level snapshot of vendor payment performance.

KPI Cards in Overview Sheet

The dashboard displays the following cards:

1. Total Outstanding Amount

Shows the total unpaid invoice amount across all vendors.

2. Paid Invoice

Displays the number or value of fully paid invoices.

3. Partially Paid Invoices

Highlights invoices with partial payments pending.

4. Average Days Overdue

Measures how late payments occur on average.

These cards help finance teams assess payment health instantly.

Charts in Overview Sheet

Paid Amount and Outstanding Amount by Month

This chart shows monthly trends of paid versus unpaid invoices. It helps identify cash flow gaps and seasonal delays.

Payment Status Distribution

Displays the proportion of paid, partially paid, and unpaid invoices.

Total Spend (Net Amount) by Vendor Category

Highlights where most vendor spending occurs.

Total Spend (Net Amount) by Month

Shows monthly procurement and vendor payment trends.

Click to Buy Vendor Payment Dashboard in Google Sheets

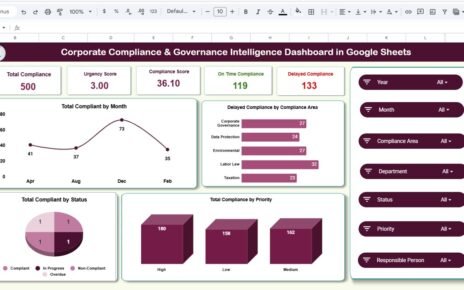

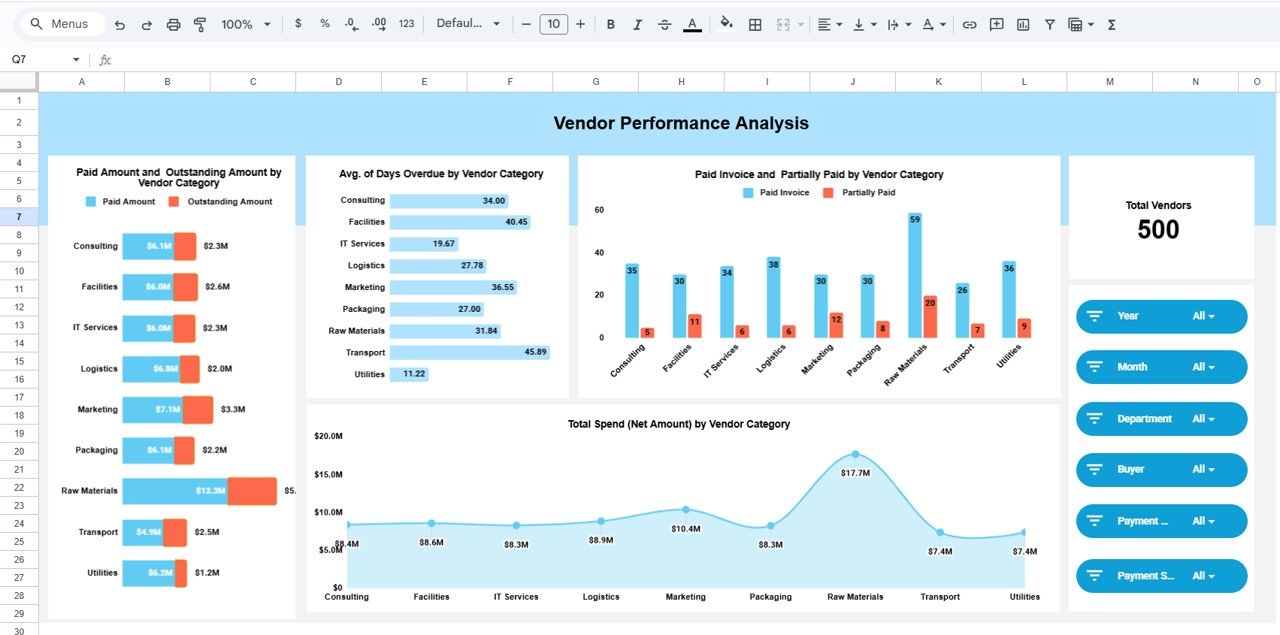

Vendor Performance Analysis

This section focuses on vendor-level insights.

Card

Total Vendors

Shows the number of active vendors in the system.

Charts in Vendor Performance Analysis

Paid Amount and Outstanding Amount by Vendor Category

Helps compare payment discipline across vendor types.

Average Days Overdue by Vendor Category

Identifies vendors associated with frequent delays.

Paid Invoice and Partially Paid by Vendor Category

Shows how effectively invoices get closed.

Total Spend (Net Amount) by Vendor Category

Helps prioritize key vendors based on spending volume.

This analysis supports better vendor negotiations and risk management.

Click to Buy Vendor Payment Dashboard in Google Sheets

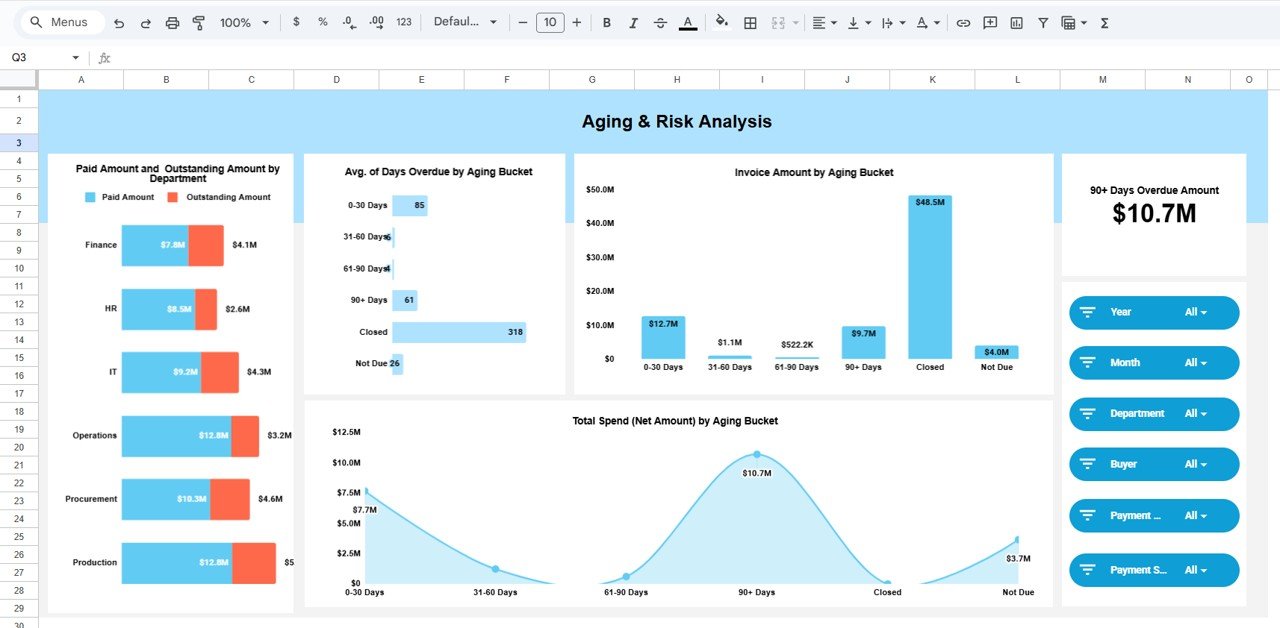

Aging & Risk Analysis

This section focuses on overdue risk and aging exposure.

Card

90+ Days Overdue Amount

Shows high-risk overdue invoices that require immediate action.

Charts in Aging & Risk Analysis

Invoice Amount by Aging Bucket

Displays invoice values across aging ranges such as 0–30, 31–60, 61–90, and 90+ days.

Average Days Overdue by Aging Bucket

Helps track how long invoices stay unpaid.

Total Spend (Net Amount) by Aging Bucket

Shows where the highest financial exposure exists.

Paid Amount and Outstanding Amount by Department

Highlights which departments contribute most to overdue payments.

This section strengthens financial risk control.

Click to Buy Vendor Payment Dashboard in Google Sheets

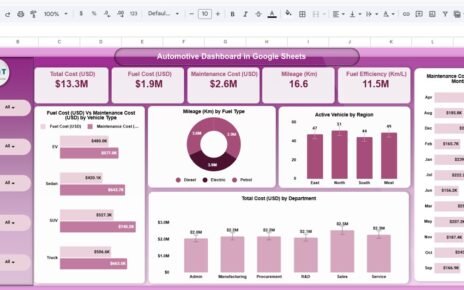

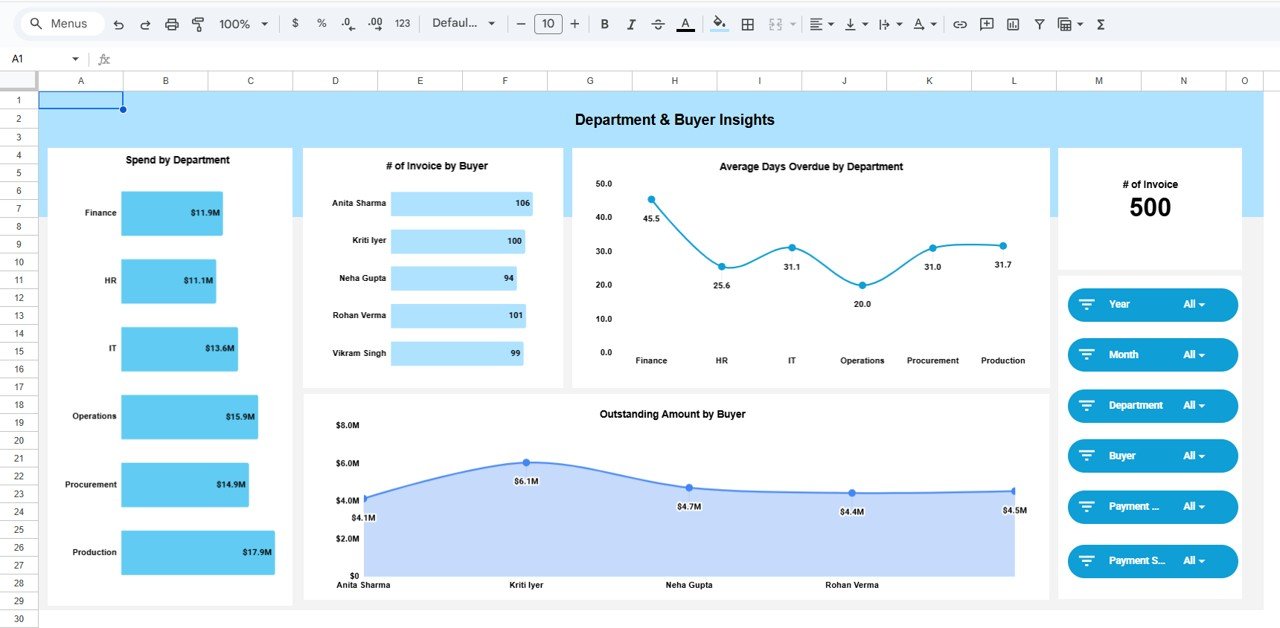

Department & Buyer Insights

This section connects payments with internal accountability.

Charts Included

Spend by Department

Shows departmental contribution to vendor spending.

Number of Invoices by Buyer

Identifies buyers handling the most invoices.

Average Days Overdue by Department

Highlights departments causing payment delays.

Outstanding Amount by Buyer

Shows buyer-level payment responsibility.

This view helps enforce accountability and improve internal processes.

Click to Buy Vendor Payment Dashboard in Google Sheets

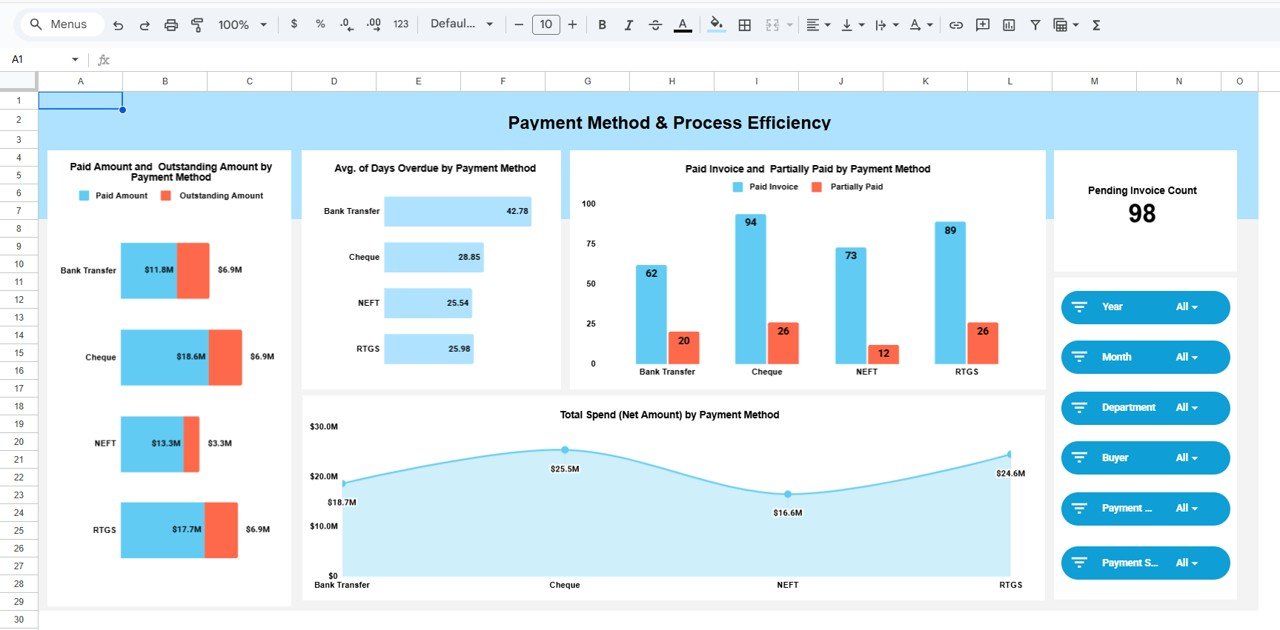

Payment Method & Process Efficiency

This section evaluates payment efficiency based on methods used.

Card

Pending Invoice Count

Shows the total number of invoices still pending payment.

Charts Included

Paid Amount and Outstanding Amount by Payment Method

Compares efficiency across bank transfer, cheque, cash, or digital payments.

Average Days Overdue by Payment Method

Helps identify slower payment channels.

Paid Invoice and Partially Paid by Payment Method

Tracks closure efficiency.

Total Spend (Net Amount) by Payment Method

Shows preferred payment channels.

This analysis helps optimize payment processes.

Click to Buy Vendor Payment Dashboard in Google Sheets

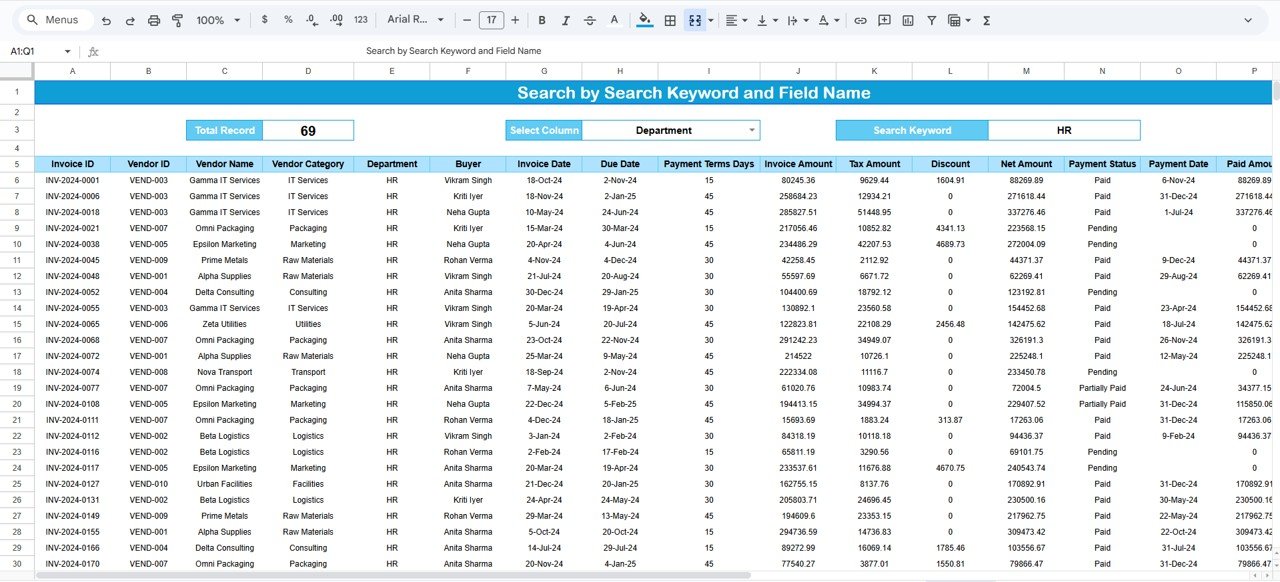

Search Functionality – Search by Keyword and Field Name

The dashboard includes a powerful Search Panel.

You can search using:

- Vendor Name

- Invoice Number

- Department

- Buyer Name

- Vendor Category

- Payment Status

- Payment Method

The search feature helps teams quickly locate invoices without manual filtering, saving significant time during audits and reviews.

Advantages of Vendor Payment Dashboard in Google Sheets

Click to Buy Vendor Payment Dashboard in Google Sheets

1. Real-Time Visibility

Teams see payment status instantly.

2. Improved Cash Flow Control

Outstanding and overdue risks remain visible at all times.

3. Better Vendor Relationships

Timely payments build supplier trust.

4. Strong Risk Management

Aging and overdue insights prevent financial surprises.

5. Easy Collaboration

Finance, procurement, and management work on the same data.

6. No Software Cost

Google Sheets keeps implementation simple and affordable.

Opportunities for Improvement

Organizations can enhance this dashboard by adding:

-

SLA tracking for vendor payments

-

Automated reminders for overdue invoices

-

Integration with accounting systems

-

Vendor scorecards

-

Forecasted cash outflow projections

These additions increase automation and control.

Best Practices for Using the Vendor Payment Dashboard

Click to Buy Vendor Payment Dashboard in Google Sheets

-

Update invoice data daily

-

Review overdue invoices weekly

-

Monitor 90+ days overdue closely

-

Balance payments across departments

-

Use insights during vendor negotiations

-

Maintain clean and consistent data entry

Following these practices ensures reliable insights.

Conclusion

A Vendor Payment Dashboard in Google Sheets is an essential financial control tool for modern organizations. It improves payment visibility, reduces overdue risks, strengthens vendor relationships, and enhances cash flow management. Because the dashboard is easy to use, visually rich, and highly customizable, it fits businesses of all sizes.

By adopting this dashboard, finance and procurement teams gain clarity, control, and confidence in managing vendor payments effectively.

Frequently Asked Questions (FAQs)

Click to Buy Vendor Payment Dashboard in Google Sheets

Who should use a Vendor Payment Dashboard?

Finance teams, accounts payable teams, procurement managers, and business owners.

Is Google Sheets secure for vendor data?

Yes, when access permissions are managed properly.

Can I customize vendor categories and payment methods?

Yes, the dashboard is fully customizable.

Does this dashboard support overdue analysis?

Yes, it includes aging buckets and risk indicators.

Can multiple users access the dashboard?

Yes, Google Sheets supports real-time collaboration.

Visit our YouTube channel to learn step-by-step video tutorials

Youtube.com/@NeotechNavigators

Click to Buy Vendor Payment Dashboard in Google Sheets