Calculate Employee Salary with TAX Using IF Function while accounting for taxes can be challenging. However, with the IF function in Excel, this task becomes much easier. In this blog post, we’ll walk you through how to calculate employee salaries with tax deductions using a practical example and formulas that are easy to apply. This approach not only saves time but also ensures accuracy in payroll management.

Let’s dive right in and show you how to calculate gross salary, apply tax rates, and compute net salary with Excel formulas!

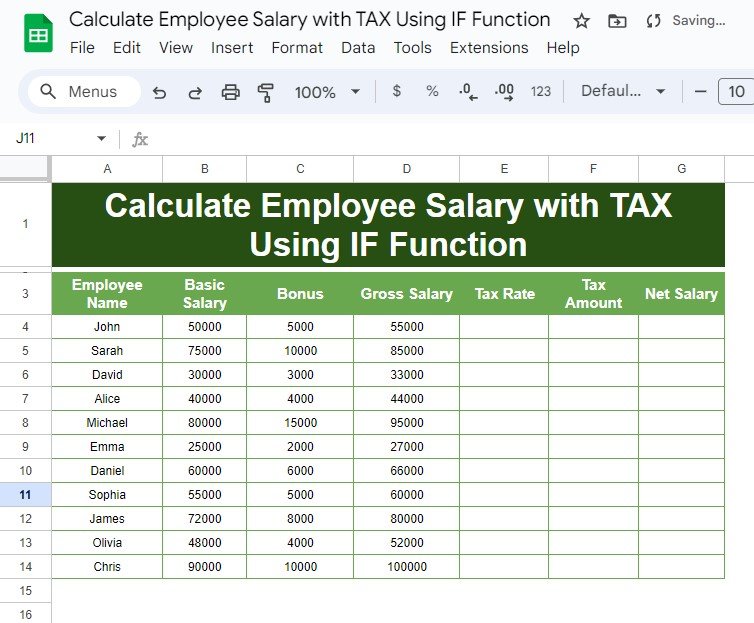

Dataset Overview

Here’s the data we’ll be using for this example. It contains essential payroll information, including:

Formulas to Calculate Salary and Tax

Here’s how we’ll calculate the gross salary, tax rate, tax amount, and net salary using simple Excel formulas.

Calculate Gross Salary

We can compute the gross salary by adding Basic Salary and Bonus:

=B4 + C4

Apply Conditional Tax Rates Using IF Function

We apply different tax rates based on the gross salary using the following formula:

=IF(D4 > 60000, 20%, IF(D4 >= 30000, 10%, 0%))

If Gross Salary > 60,000: Apply a 20% tax rate

If Gross Salary >= 30,000: Apply a 10% tax rate

If Gross Salary < 30,000: No tax is applied

Calculate Tax Amount

The tax amount is calculated by multiplying the gross salary by the applicable tax rate:

=D4 * E4

2.4 Calculate Net Salary

We compute the net salary by subtracting the tax amount from the gross salary:

=D4 – F4

Step-by-Step Example Output

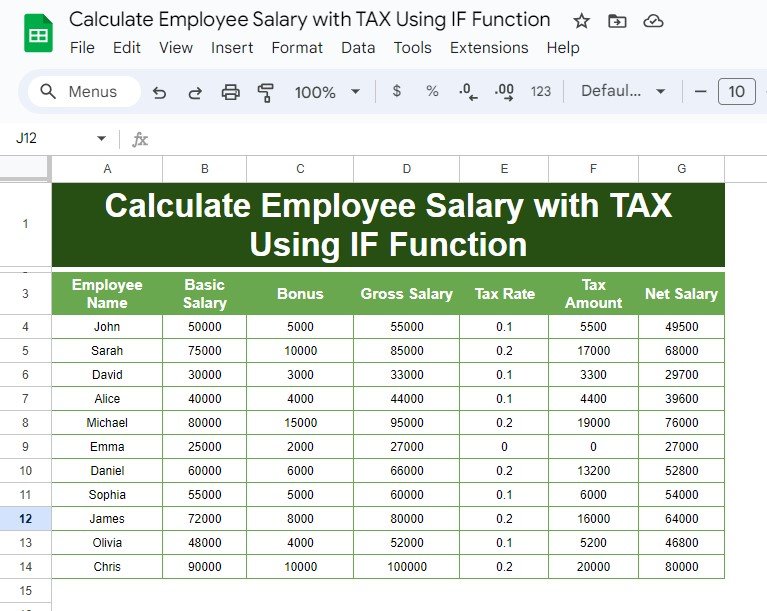

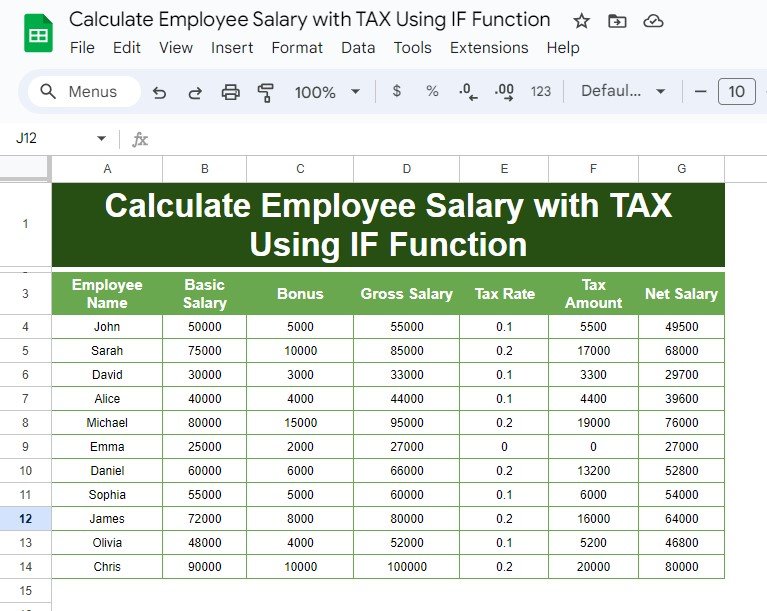

After applying these formulas, your worksheet will display the following output:

This example ensures that tax is applied correctly and that the net salary reflects the appropriate deductions.

Why Use This Method?

- Accurate Tax Calculation: The IF function ensures precise application of tax rates based on gross salary.

- Time-Saving Automation: No more manual tax calculations—Excel does the work for you.

- Scalable Solution: Easily apply this method to a large dataset with multiple employees.

Final Thoughts

Calculating employee salaries with tax deductions is now easier than ever with Excel’s IF function. By following the steps in this post, you can ensure that payroll processing is both accurate and efficient. No more missed deductions or manual errors!

Visit our YouTube channel to learn step-by-step video tutorials

Youtube.com/@NeotechNavigators

View this post on Instagram