If you’ve ever wondered how to calculate compound interest easily, you’re in luck! In this guide, we’ll walk you through a simple yet powerful method to calculate compound interest in Google Sheets. Whether you’re managing personal finances, planning an investment, or just curious about how compound interest works, this step-by-step guide will help you get the answers you need without the hassle of complicated formulas.

What is Compound Interest?

Before we dive into the technical details, let’s quickly recap what compound interest is. Unlike simple interest, which is calculated on the principal amount only, compound interest is calculated on the principal amount plus any accumulated interest. This means that you earn “interest on interest,” which can significantly boost your returns over time.

The Formula for Compound Interest

- A = Final amount (including principal and interest)

- P = Principal (initial amount)

- r = Annual interest rate (in decimal form)

- n = Number of times interest is compounded per year

- t = Time the money is invested or borrowed for (in years)

Don’t worry if this seems overwhelming—Google Sheets can handle the math for you!

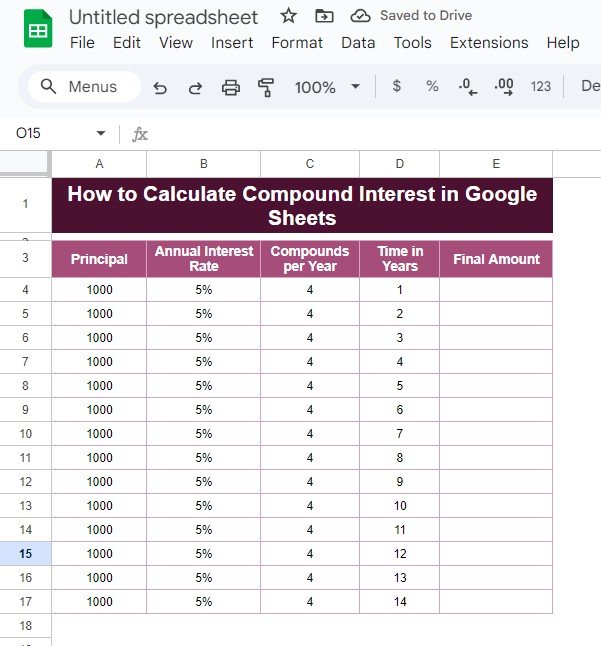

Example Data

Let’s work with an example to see how easy it is to calculate compound interest in Google Sheets. Imagine you have the following data in range A3

in your Google Sheets:

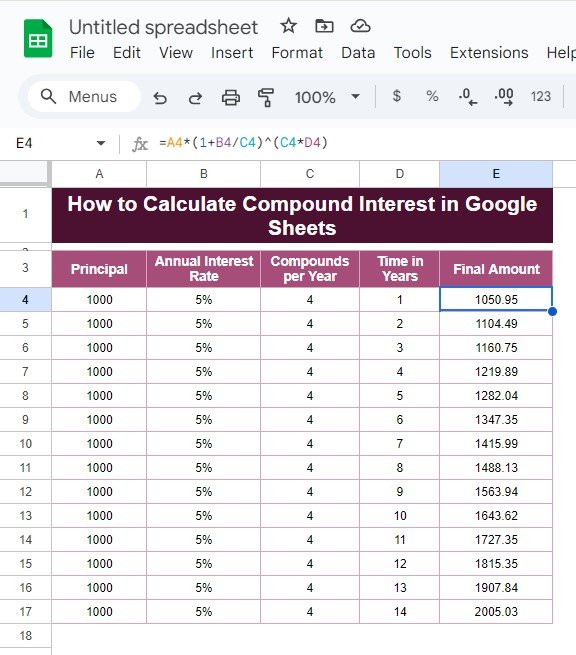

How to Use the Formula in Google Sheets

To calculate compound interest in Google Sheets, you’ll use this simple formula:

Let’s break down what each part of the formula does:

- A4: This refers to the principal (the initial amount of money).

- B4/C4: This calculates the interest rate per period by dividing the annual interest rate (B4) by the number of times interest is compounded per year (C4).

- C4 \times D4: This multiplies the number of times interest is compounded per year (C4) by the number of years (D4), giving the total number of compounding periods.

The entire formula calculates the future value of the investment, factoring in compound interest.

Once you’ve entered this formula, drag it down to calculate the future value for each row of data.

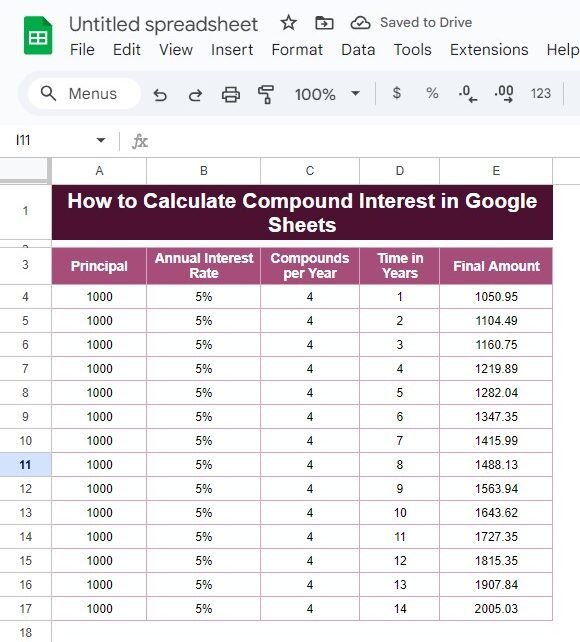

Output: The Results

After applying the formula, here’s the final output:

Why This Method is Great for You

There are several reasons why calculating compound interest in Google Sheets is a fantastic option:

- It’s Free: You don’t need to purchase any expensive software—Google Sheets is completely free to use.

- Automated Calculations: Once you set up the formula, Google Sheets does all the hard work for you, so you don’t have to worry about errors.

- Real-time Adjustments: You can easily change the values for principal, interest rates, and time to see how different factors affect the final amount.

Conclusion: Make Compound Interest Work for You

By using this simple method in Google Sheets, you can easily calculate compound interest and plan your finances effectively. Whether you’re investing for the future or managing a loan, this tool makes it easy to see how your money grows over time. No need to stress over complex formulas—Google Sheets does all the work for you!

Visit our YouTube channel to learn step-by-step video tutorials

Youtube.com/@NeotechNavigators

View this post on Instagram