Are you trying to calculate the rate of return on an investment using Google Sheets? Well, look no further! In this blog post, we’ll walk you through the RRI Function in Google Sheets, which is perfect for calculating the compound interest rate required for your investments to grow over a specific period.

Whether you’re an investor, a financial analyst, or just someone looking to better understand your savings or investments, this tutorial is designed to help you with real-life examples. Let’s dive in!

What is the RRI Function in Google Sheets?

The RRI function stands for Rate of Return on Investment and helps to calculate the annual rate required for an investment to grow from its present value to a future value over a given period.

In simple terms, RRI gives you the interest rate needed for a certain amount of money to grow to a future value, based on the number of periods (like months or years). The formula is:

=RRI(periods, present _value, future _value)

How does this function work?

- Periods: The number of time periods over which the money will grow (like months or years).

- Present Value: The current amount of money you have (initial investment).

- Future Value: The amount of money you want to have after the given periods.

Example Data for the RRI Function

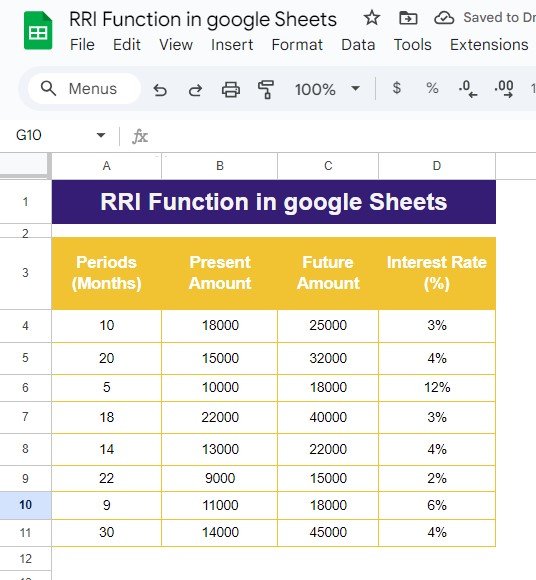

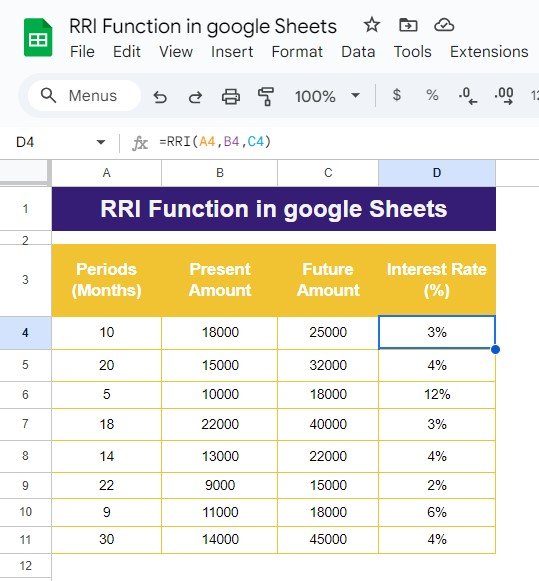

To make this super clear, let’s take a look at some example data. In our Google Sheet, the data is available from range A3

, which includes columns for periods, present amount, future amount, and interest rate. Here’s a snapshot of the data we’ll use:

These values represent the time period (in months), how much money you have right now, how much you want in the future, and the calculated interest rate.

Applying the RRI Formula in Google Sheets

Now let’s apply the RRI formula to get the interest rate that would achieve these future values. The formula we used in Google Sheets is:

=RRI(A4, B4, C4)

- A4: Represents the number of periods (months).

- B4: Represents the present amount or the initial investment.

- C4: Represents the future amount, or how much you want at the end of the period.

Example Calculation:

For the first row, where the number of periods is 10 months, the present value is $18,000, and the future value is $25,000, the formula would look like this:

=RRI(10, 18000, 25000)

The result of this formula gives you the interest rate required to grow $18,000 to $25,000 over 10 months.

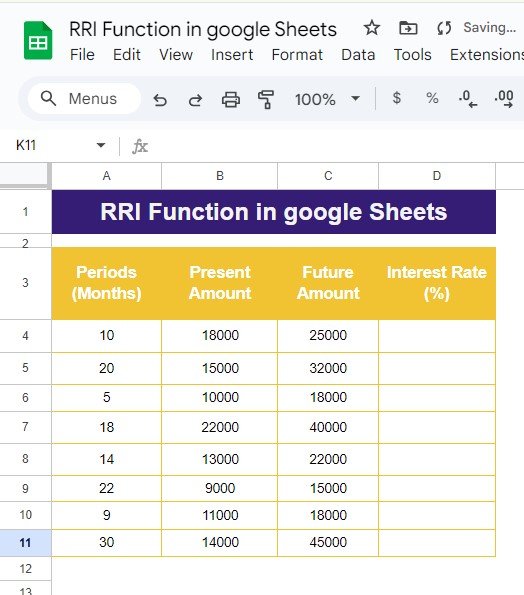

Output of the RRI Function

Here’s a look at the output for the entire dataset:

Why Use the RRI Function?

The RRI function is a useful tool for calculating the necessary interest rate for an investment to reach a future value. Instead of guessing what interest rate you need, you can quickly get an accurate answer using this simple formula.

Key Benefits of Using RRI:

- Easy to Use: With a simple formula, you can calculate interest rates quickly and efficiently.

- Helps in Financial Planning: It’s an essential tool for anyone who wants to understand how their investments will grow over time.

- Accuracy: The RRI function provides precise results, taking the guesswork out of investment planning.

Wrapping Up

Understanding how your investments can grow and knowing the interest rate required is crucial for making informed financial decisions. The RRI function in Google Sheets allows you to calculate this with ease. Just plug in the periods, present amount, and future amount, and Google Sheets will do the rest.

Visit our YouTube channel to learn step-by-step video tutorials

Youtube.com/@NeotechNavigators

View this post on Instagram

Click here to Make the copy of this Template