Have you ever wondered how to calculate the yield of a bond bought at a discount? Well, Google Sheets has a function that can make this process super simple: YIELDDISC Function in Google Sheets. Whether you’re a financial professional or just someone trying to better understand bond yields, this guide will walk you through how to use the YIELDDISC function step by step with an easy example. Let’s dive in!

What Exactly Is the YIELDDISC Function?

Before we get into the example, let’s first understand what the YIELDDISC function does. In simple terms, this function helps you calculate the annual discount yield of a bond. In other words, it tells you how much return you’ll get from a bond bought at a discount, based on important factors like when you purchased it and when it will mature.

The formula you’ll use looks like this:

=YIELDDISC(settlement, maturity, price, redemption)

Let’s break down each part:

- Settlement: The date you bought the bond.

- Maturity: The date when the bond reaches its full value and matures.

- Price: The price you paid for the bond, as a percentage of its full value.

- Redemption: The bond’s value at maturity (usually 100%).

A Simple Example Using the YIELDDISC Function

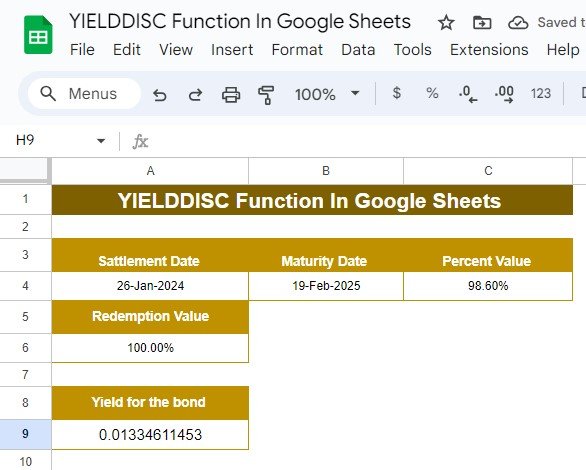

Now, let’s make this easy to understand with a quick example. Imagine you have a bond and the following information in Google Sheets:

With this data, you want to calculate how much yield this bond will provide by the time it matures. Thankfully, the YIELDDISC function can help us do this quickly and easily.

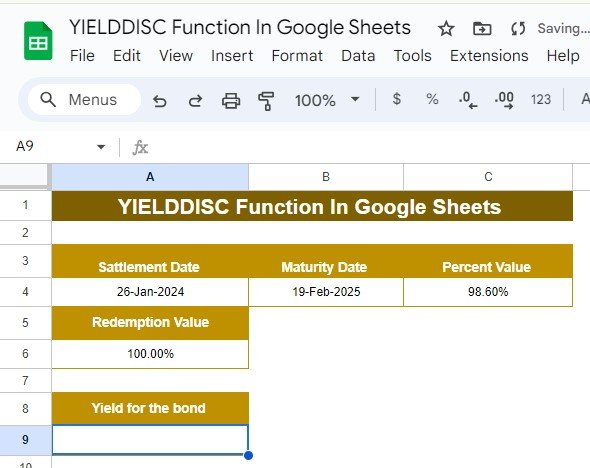

How to Use the YIELDDISC Formula

Now for the fun part: let’s apply the formula in Google Sheets! You’ll use this formula:

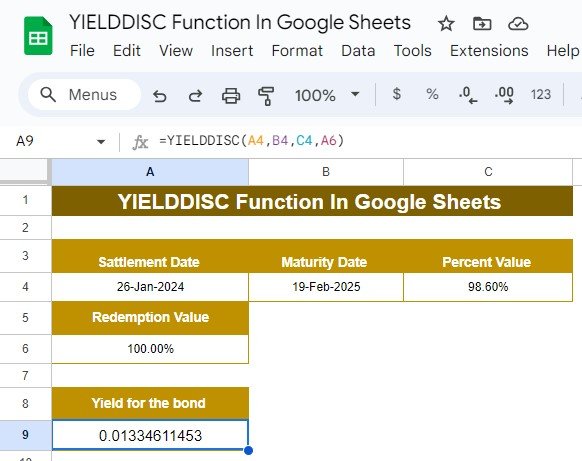

=YIELDDISC(A4, B4, C4, A6)

Here’s a breakdown of what’s happening in the formula:

A4 is the settlement date (the day you bought the bond).

B4 is the maturity date (the day the bond matures).

C4 is the bond’s purchase price, which is 98.60% in this example.

A6 is the redemption value, which is typically 100%.

Once you enter this formula into Google Sheets, it will automatically calculate the bond’s discount yield for you. Easy, right?

What’s the Result?

After hitting Enter, Google Sheets will give you the bond’s discount yield. This value represents how much return (in percentage terms) you’ll earn on the bond from the date of purchase to maturity. It’s a simple and accurate way to see how much you’re gaining from your investment!

Why Use the YIELDDISC Function?

You may be thinking, “Why should I use the YIELDDISC function?” Well, here are a few reasons why it’s a great tool:

- It saves you time: You don’t have to manually calculate complex bond yields. Let Google Sheets do the heavy lifting for you!

- It ensures accuracy: By using this function, you minimize errors that often come with manual calculations.

- It simplifies financial planning: This function is a great tool for anyone managing multiple bonds or trying to understand their financial returns more clearly.

Final Thoughts

And there you have it! Using the YIELDDISC function in Google Sheets is a fast and easy way to calculate bond yields. Whether you’re an experienced investor or just starting out, this function can simplify your bond analysis and save you valuable time.

Visit our YouTube channel to learn step-by-step video tutorials

Youtube.com/@NeotechNavigators