Preparing your taxes can feel like a daunting task, but with the right tools, you can streamline the entire process and ensure you don’t miss any critical steps. One such tool is the Tax Preparation Checklist in Google Sheets. This ready-to-use template is designed to guide you through every stage of the tax preparation process, helping you stay organized, manage deadlines, and track your progress with ease.

In this article, we’ll explore the features of the Tax Preparation Checklist in Google Sheets, its benefits, and how it can help simplify your tax filing experience.

Why Use a Tax Preparation Checklist in Google Sheets?

A well-organized tax preparation checklist is essential for ensuring that your tax filing process goes smoothly. Here are some key reasons why using a Tax Preparation Checklist in Google Sheets is a great idea:

1. Improved Organization

The checklist helps you stay on top of all the necessary steps to prepare your taxes. With each item listed and tracked, you reduce the chances of forgetting vital tasks.

2. Easy to Access and Update

Google Sheets is cloud-based, so you can access it from any device at any time. It also allows for real-time updates, meaning you can make changes and track your progress as you go.

3. Cost-Effective

This tool is free to use and provides a great alternative to expensive tax preparation software or hiring professionals. You can prepare your taxes independently while keeping everything organized.

Key Features of the Tax Preparation Checklist in Google Sheets

Let’s dive into the key features that make the Tax Preparation Checklist in Google Sheets a valuable resource for anyone looking to prepare their taxes with ease.

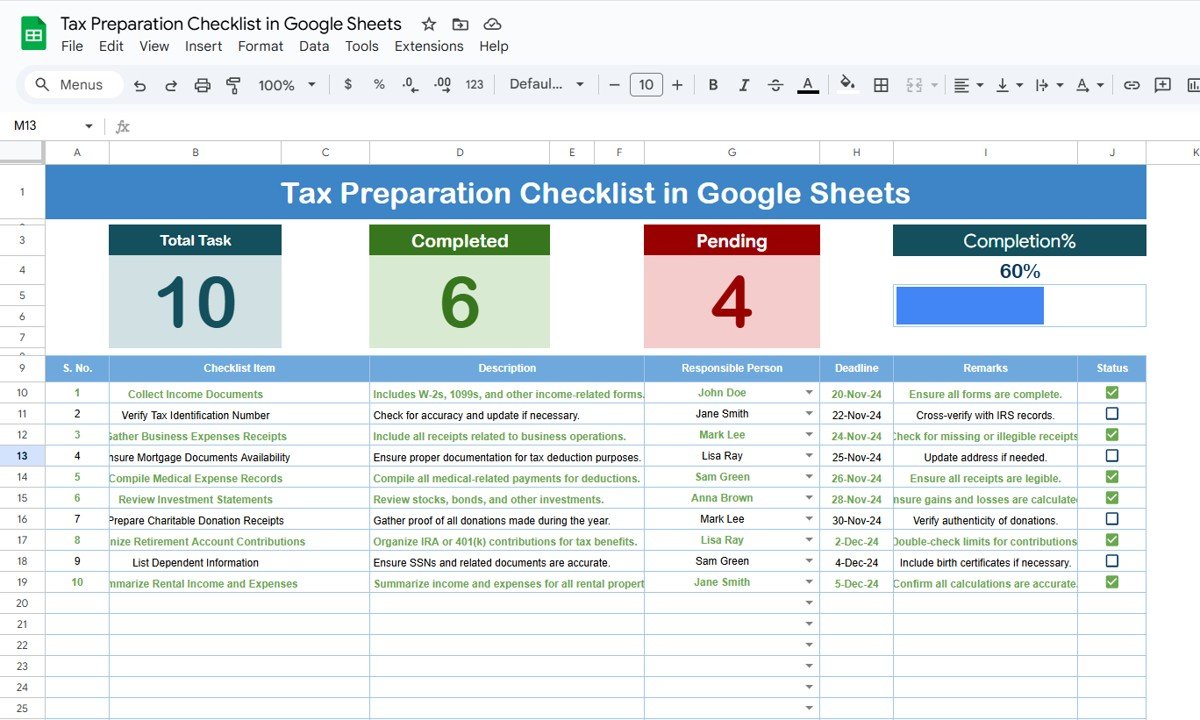

1. Two Worksheets for Better Structure

The template consists of two worksheets to keep your tasks organized:

-

Tax Preparation Checklist Worksheet: This is where all the tax preparation tasks are listed. You will enter all relevant information, such as task descriptions, responsible person, deadlines, and more.

-

List Worksheet: This worksheet allows you to capture a list of Responsible Persons. It is used to create a drop-down list for easy selection of individuals responsible for various tasks.

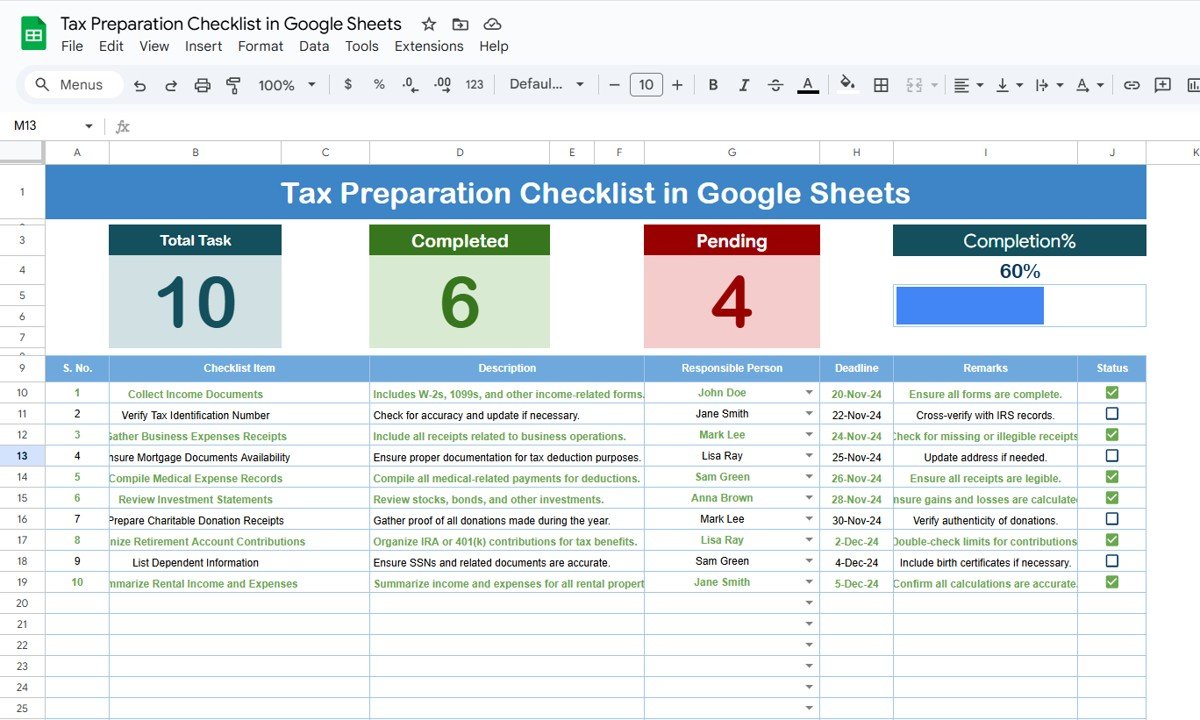

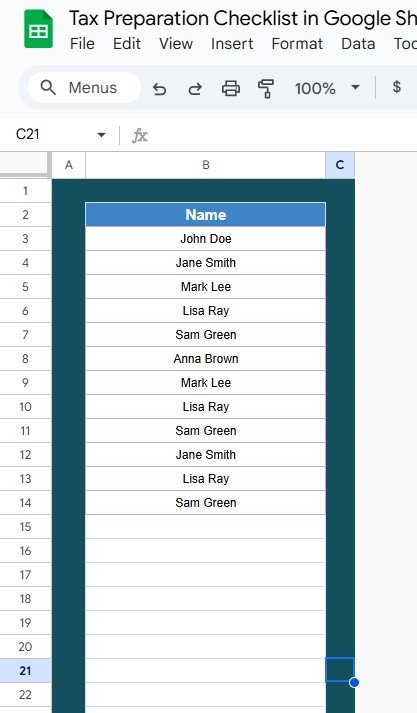

2. Top Section: Overview and Progress Tracking

At the top of the checklist worksheet, you’ll find an overview section that provides valuable insights into your progress:

-

Total Count: Displays the total number of tasks in your checklist.

-

Completed Count: Shows the number of tasks that have been completed.

-

Pending Count: Indicates how many tasks are still pending.

-

Progress Bar: Visually tracks the percentage of completed tasks, helping you stay motivated.

3. Checklist Table: Simple and Effective

The main part of the template is the checklist table, where you’ll record your tasks. The columns include:

Click to buy Tax Preparation Checklist in Google Sheets

-

Serial No.: A sequential number for task organization.

-

Checklist Item: The specific task you need to complete.

-

Description: A short description of the task.

-

Responsible Person: The person in charge of the task.

-

Deadline: The due date for the task.

-

Remarks: Any additional notes or observations about the task.

-

Status: A checkbox to mark tasks as ✔ completed or ✘ pending.

This organized structure ensures that every detail is covered, and you can easily track your progress.

Click to buy Tax Preparation Checklist in Google Sheets

Advantages of Using a Tax Preparation Checklist in Google Sheets

Using a Tax Preparation Checklist provides several advantages:

- Simplifies the Tax Filing Process

By breaking down the tax preparation tasks into smaller, manageable steps, you reduce the chances of overlooking any important documents or steps. This systematic approach makes the process less overwhelming.

- Helps Meet Deadlines

The checklist allows you to set deadlines for each task, helping you stay on track and meet your tax filing deadlines on time.

- Better Team Collaboration

If you’re working with others on your tax preparation (e.g., an accountant or family members), the checklist makes collaboration easy. You can assign tasks to specific people and track their progress, ensuring that everyone is on the same page.

- Real-Time Progress Tracking

With the built-in progress bar, you can easily see how much of your tax preparation is completed and what still needs to be done. This real-time feedback keeps you motivated and ensures you stay on track.

Opportunities for Improvement in the Tax Preparation Checklist

Click to buy Tax Preparation Checklist in Google Sheets

While the Tax Preparation Checklist is a fantastic tool, there are always opportunities for improvement. Here are a few ways you can enhance the template:

- Automate Data Entry

You could integrate the checklist with other Google Sheets or tools (like Google Finance) to automatically pull in your financial data. This would minimize manual data entry and make your tax preparation even more efficient.

- Integrate With Accounting Software

You could link the checklist with accounting software (such as QuickBooks or Xero) to pull in your financial statements directly. This integration would make the process even more streamlined.

- Add Conditional Formatting

Using conditional formatting, you can highlight overdue tasks or important deadlines in red. This would make it even easier to spot tasks that need immediate attention.

Best Practices for Using the Tax Preparation Checklist

To get the most out of your Tax Preparation Checklist in Google Sheets, here are some best practices to follow:

- Update Your Checklist Regularly: Make sure to update the checklist as you complete tasks or receive new information. Regular updates will help keep everything organized and ensure you’re always on track.

- Assign Clear Deadlines: Set clear deadlines for each task, ensuring you stay on schedule and don’t miss any important steps in the tax preparation process.

- Use Color Coding and Comments: Color-code tasks by priority and use comments for additional notes or reminders. This will make your checklist easier to navigate and help you quickly identify high-priority tasks.

- Review and Adjust Monthly: At the start of each month, review your tax preparation checklist to see if any new tasks need to be added or deadlines adjusted. This helps you stay ahead of your tax responsibilities.

Conclusion

The Tax Preparation Checklist in Google Sheets is a valuable tool for anyone looking to prepare their taxes in an organized, efficient, and stress-free way. With its simple structure, real-time progress tracking, and customizable features, it helps you manage your tax tasks and deadlines with ease. By following the best practices outlined in this article, you can make the most of this template and ensure that your tax filing is smooth and timely.

Visit our YouTube channel to learn step-by-step video tutorials

Youtube.com/@NeotechNavigators

Watch the step-by-step video Demo: