Managing finances can feel overwhelming, especially when multiple expenses, bills, and financial goals overlap throughout the month. That’s where a Budget Tracking Calendar in Google Sheets becomes your best financial companion.

A Budget Tracking Calendar is a digital planner that helps you record, visualize, and manage your income and expenses day-by-day, week-by-week, and month-by-month. It combines the power of budgeting and the clarity of a calendar into a single Google Sheets file — allowing you to track payments, due dates, savings, and spending patterns with complete ease.

Because it’s built in Google Sheets, the calendar is cloud-based, accessible anywhere, and easy to share with your family or finance team. You don’t need any coding or software skills — just open it, enter your data, and watch the dashboard update automatically.

Click to buy Budget Tracking Calendar in Google Sheets

Why Use Google Sheets for Budget Tracking?

Many people rely on manual notebooks or complex accounting tools to monitor expenses. However, Google Sheets offers the perfect balance between simplicity and automation.

Here’s why it stands out:

- Free and Cloud-Based: No installation or subscription required. Access it from any device.

- Customizable: Add your own categories, goals, and formatting.

- Real-Time Collaboration: Multiple users can update the same sheet at once.

- Visual Clarity: Use color coding, charts, and conditional formatting to visualize your spending.

- Integration Ready: Easily connect with Google Forms or Apps Script for automation.

In short, the Budget Tracking Calendar in Google Sheets transforms everyday expense tracking into a structured and stress-free process.

Key Features of the Budget Tracking Calendar in Google Sheets

This ready-to-use calendar comes with five interactive worksheet tabs, each serving a unique purpose. Let’s explore them one by one.

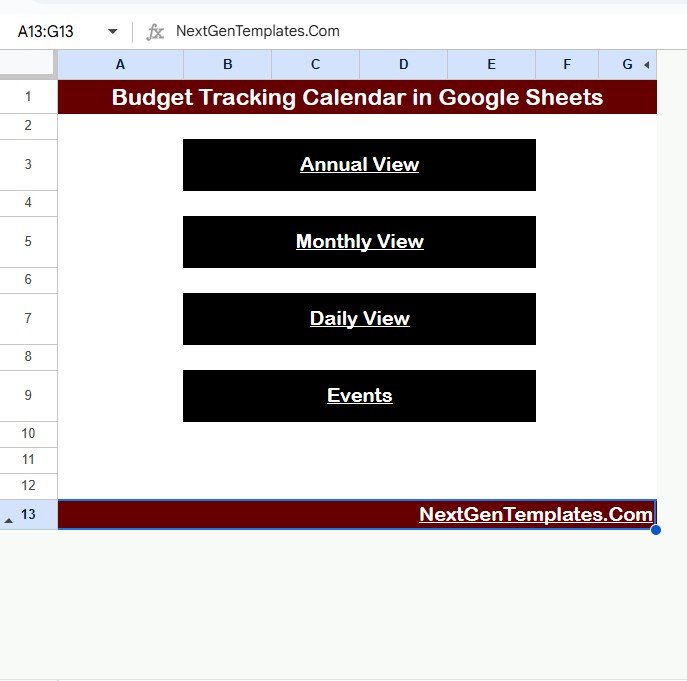

Home Sheet Tab — The Control Center

The Home Sheet acts as the main navigation page of the template. It provides quick buttons that let you jump directly to other sheets without scrolling or searching.

Buttons Available:

- Annual View

- Monthly View

- Daily View

- Events

You can personalize this sheet with your name, business logo, or even a motivational quote about financial discipline. It’s designed for convenience — a true dashboard experience for your budgeting calendar.

Click to buy Budget Tracking Calendar in Google Sheets

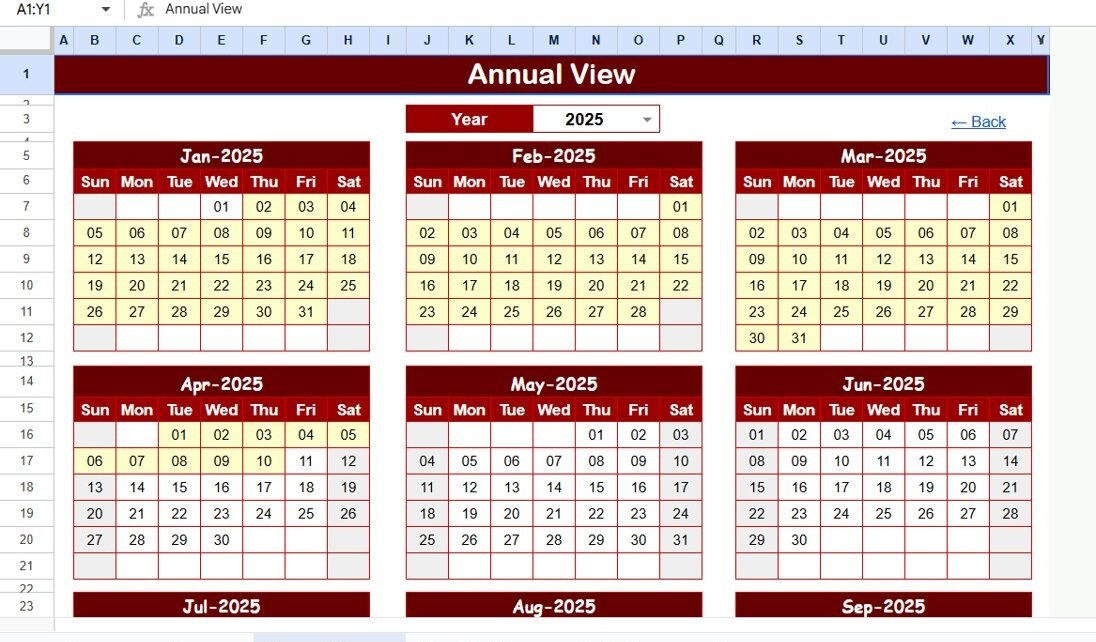

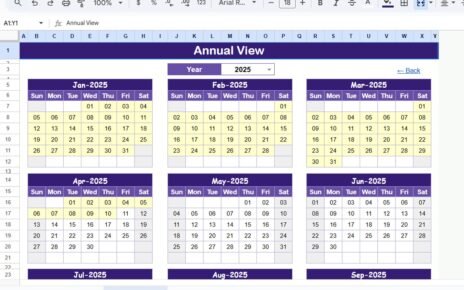

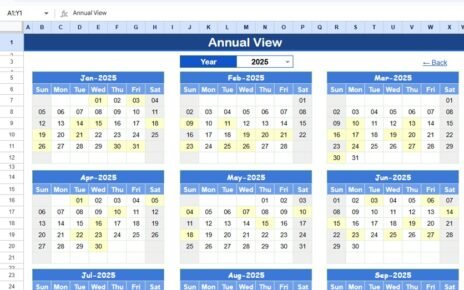

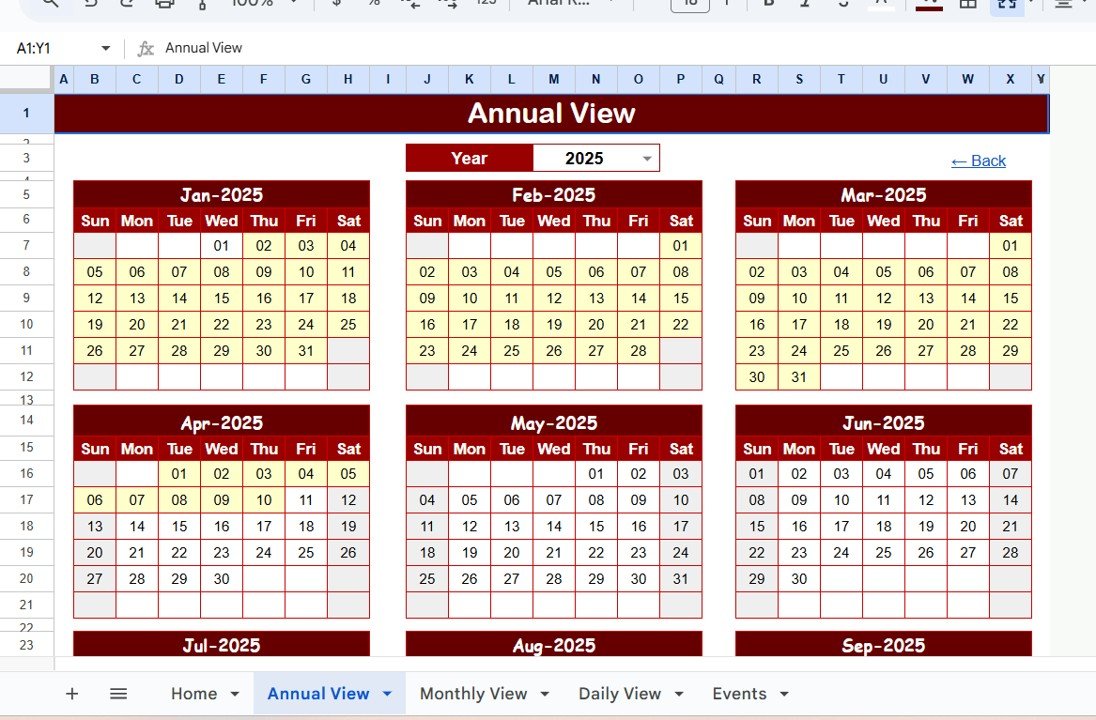

Annual View Sheet Tab — Yearly Financial Overview

This sheet offers a 12-month snapshot of your financial activity. It helps you plan, track, and review your spending and savings trends throughout the year.

Key sections include:

- Input Group:

- Select the Year to automatically update all months.

- Choose the Starting Month for fiscal or custom financial years.

- Set the Starting Day of the Week to align with your preferences (Sunday or Monday).

With a single glance, you can view monthly expense totals, scheduled payments, and upcoming events — ensuring you never miss a due date again.

Click to buy Budget Tracking Calendar in Google Sheets

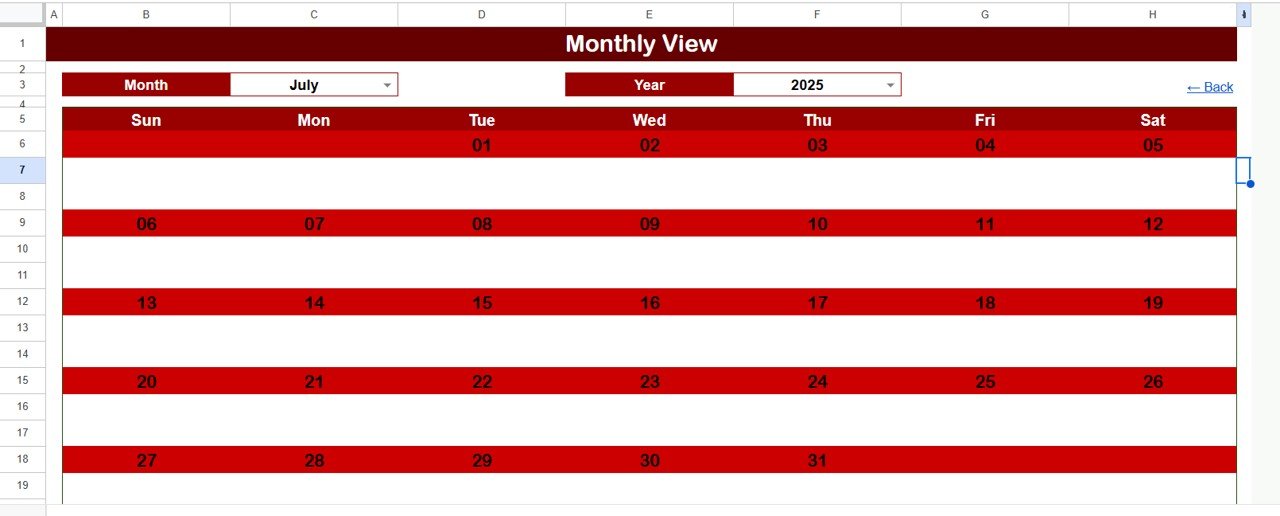

Monthly View Sheet Tab — Track One Month at a Time

The Monthly View displays a detailed calendar for the selected month. From the top menu, you can choose any Month and Year, and the entire sheet adjusts automatically.

Each date cell can show your expense event such as bill payments, income receipts, savings transfers, or financial reminders.

If more than one transaction occurs on a given day, it displays “more than 1…” to indicate multiple entries. This keeps the calendar clean, readable, and uncluttered.

Example:

On May 5, you might have:

- Rent payment

- Utility bill

- Grocery expense

Instead of listing all three, it shows “more than 1…” so your layout stays neat.

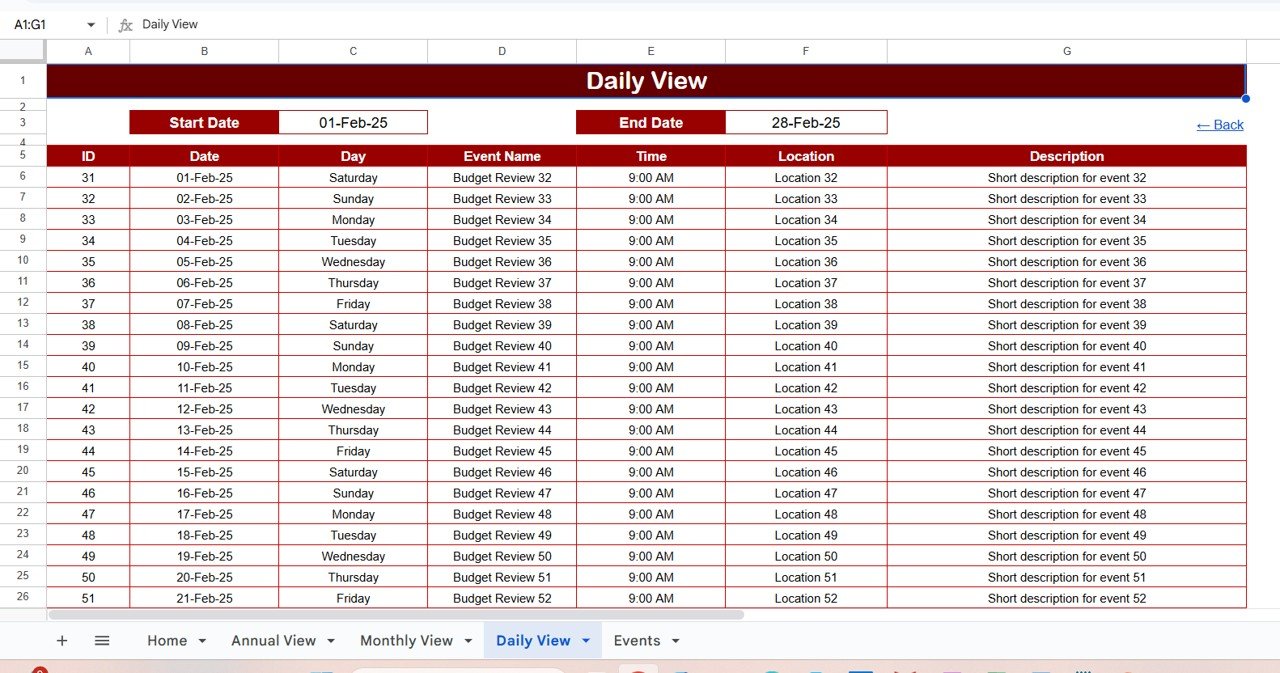

Daily View Sheet Tab — Focused Financial Insights

The Daily View Sheet is perfect for users who want to zoom in on a specific date range.

At the top, you can select a Start Date and an End Date using built-in calendar icons. Once selected, the sheet automatically filters and displays all related events, payments, or transactions within that range.

This view helps you identify your highest spending days, recurring expenses, and short-term trends — making it ideal for detailed analysis.

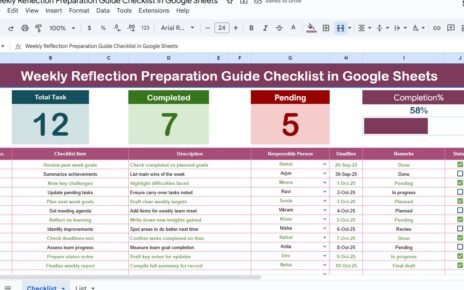

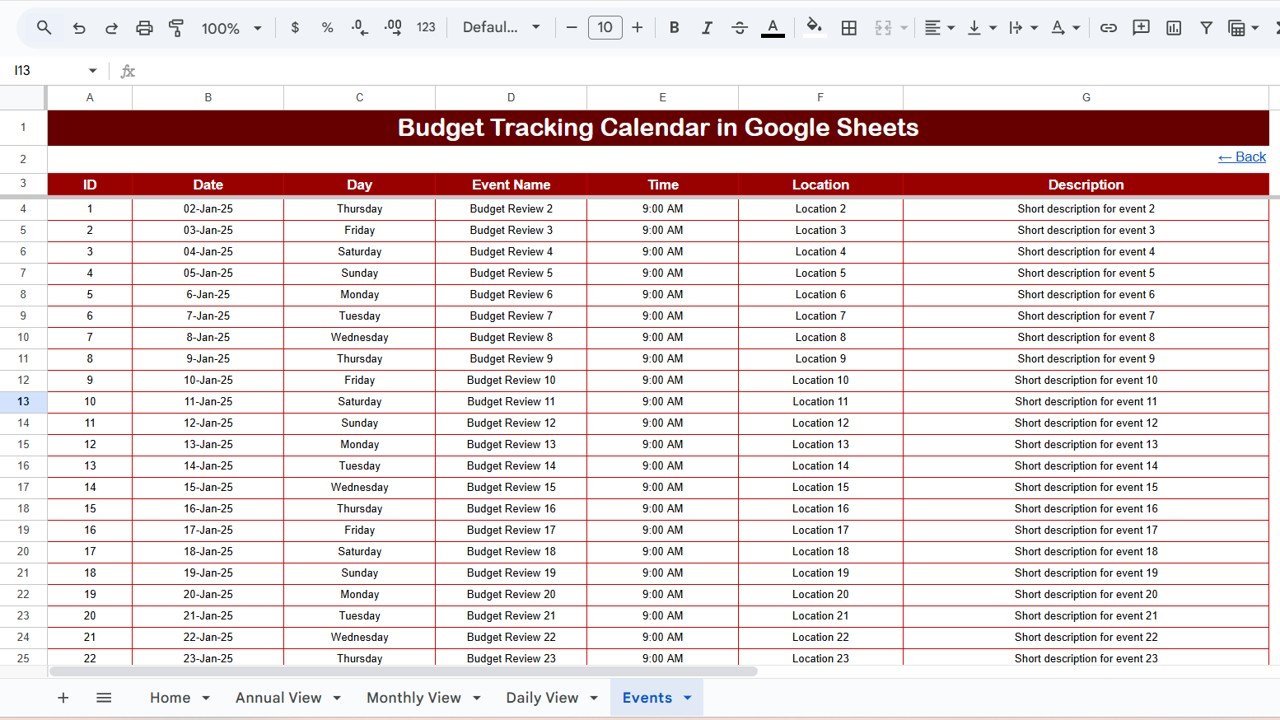

Events Sheet Tab — The Financial Database

The Events Sheet is the data backbone of your Budget Tracking Calendar. Every event — whether an expense, income, or reminder — gets stored here.

Click to buy Budget Tracking Calendar in Google Sheets

How the Budget Tracking Calendar Improves Financial Management

This calendar goes far beyond basic data entry — it helps you understand your spending behavior and optimize your financial decisions.

Here’s how it helps you stay in control:

- Visual Financial Awareness: You can instantly see which months or weeks have higher spending.

- Timely Bill Reminders: The calendar format prevents missed payments or penalties.

- Expense Categorization: Track spending by category (housing, food, entertainment, etc.).

- Budget vs. Actual Tracking: Compare your planned budget with real-time spending.

- Goal Achievement: Monitor savings goals such as emergency funds, travel budgets, or investments.

How to Use the Budget Tracking Calendar Effectively

Follow these simple steps to get started:

Enter Data in Events Sheet: Add your daily expenses, incomes, or reminders.

View Annual Summary: Check the yearly total and trends in the Annual View tab.

Use Monthly View: Zoom in on a specific month to plan and adjust your budget.

Analyze Daily Data: Identify patterns or overspending days in the Daily View.

Navigate Using Home Tab: Quickly switch between views without losing time.

Once set up, this template becomes a powerful budgeting system — helping you save money, reduce stress, and make informed financial decisions every single day.

Advantages of Using a Budget Tracking Calendar in Google Sheets

Using this calendar can completely transform how you manage money. Here are the top advantages:

1. Real-Time Access

Access your budget anytime, anywhere — whether you’re at work, traveling, or at home.

2. Easy Customization

Add new categories, modify formulas, or apply your own color schemes to match your preferences.

3. No Need for Paid Software

Why pay for budgeting apps when Google Sheets offers the same flexibility — for free?

4. Data Security and Cloud Backup

Your data automatically saves to Google Drive, ensuring it’s safe and always recoverable.

5. Better Collaboration

Share the calendar with family members or colleagues for transparent financial management.

6. Instant Calculations

Use formulas to auto-calculate totals, percentages, or averages in real time.

7. Clear Visualization

Combine charts, bars, and conditional formatting to visualize trends quickly.

Opportunities for Improvement

Even the best tools can be enhanced over time. Here are some creative improvements you could make to this template:

- Add expense category filters (e.g., Food, Rent, Utilities).

- Integrate Google Apps Script for email reminders of due bills.

- Include pie charts to show spending by category.

- Use pivot tables for advanced analysis.

- Connect it with Google Forms for automatic transaction input.

By implementing these upgrades, you can make your Budget Tracking Calendar even more powerful and time-saving.

Best Practices for Using the Budget Tracking Calendar

To get the best results from your budgeting calendar, follow these expert-recommended practices:

Update Daily: Enter transactions as soon as they happen.

Categorize Properly: Label each entry with consistent categories.

Use Color Codes: Mark income in green, expenses in red, and savings in blue.

Set Monthly Goals: Define spending and saving targets before the month begins.

Review Weekly: Spend 5 minutes every Sunday reviewing your progress.

Use Filters: Quickly analyze expenses above a certain threshold.

Back Up Monthly: Save a local copy at the end of every month for recordkeeping.

Consistency and discipline are key — treat your calendar as your personal financial partner.

Example Use Cases of a Budget Tracking Calendar

This tool can be adapted for different personal and professional needs. Here are some examples:

- Personal Finance: Track groceries, bills, and household expenses.

- Small Businesses: Manage operational costs, sales revenue, and cash flow.

- Event Planners: Schedule payments and track expenses per event.

- Nonprofits: Plan donations, campaigns, and fund allocation.

- Students: Monitor pocket money, fees, and project costs.

No matter who you are, this calendar helps simplify financial management.

Conclusion

A Budget Tracking Calendar in Google Sheets is more than just a spreadsheet — it’s a visual financial assistant that helps you make better money decisions, avoid missed payments, and achieve financial goals with confidence.

From the Annual Overview to the Daily Details, each sheet in the template plays a vital role in helping you manage income, expenses, and savings. And because it’s built on Google Sheets, it’s flexible, secure, and easy to use for everyone — whether you’re an individual, family, or small business owner.

Start using it today, stay organized, and take control of your finances like never before.

Frequently Asked Questions (FAQs)

What is the main purpose of a Budget Tracking Calendar in Google Sheets?

It helps you manage your income, expenses, and financial events in one interactive calendar format, providing a clear visual overview of your finances.

Can I customize the calendar for my personal needs?

Yes! You can modify categories, colors, and formulas according to your preferences or business requirements.

Do I need advanced spreadsheet skills to use it?

Not at all. The template uses simple formulas and dropdowns. Anyone familiar with basic Google Sheets can use it easily.

How do I share this calendar with my spouse or team?

Click Share in the top-right corner of Google Sheets and add their email addresses. You can grant them view or edit access.

Can I track multiple budgets in one file?

Yes, you can duplicate the “Events” and “Monthly View” sheets for different projects or departments and rename them accordingly.

Is the data secure?

Yes. Since it’s stored on your Google Drive, your data remains private and automatically backed up.

What devices can I use to access this calendar?

You can open it from any device — laptop, tablet, or smartphone — using your Google account.

Visit our YouTube channel to learn step-by-step video tutorials

Youtube.com/@NeotechNavigators