Managing the mortgage process can often feel overwhelming due to the many tasks and deadlines involved. Whether you’re applying for a new mortgage or managing an existing one, staying organized is essential. The Mortgage Checklist in Google Sheets is a simple, yet powerful tool that helps you track each step of the mortgage process, from document gathering to final approval.

In this article, we will explore the Mortgage Checklist in Google Sheets, its features, and how it can help you stay on top of your mortgage-related tasks, ensuring you don’t miss any critical steps.

What is the Mortgage Checklist in Google Sheets?

The Mortgage Checklist in Google Sheets is a ready-to-use template designed to help you organize, track, and manage all the tasks involved in your mortgage process. From preparing the necessary documents to meeting deadlines, this checklist ensures that you stay on track throughout the process.

The template consists of two main worksheets: the Mortgage Checklist Sheet and the List Sheet, both of which make tracking and assigning tasks easy and efficient.

Key Features of the Mortgage Checklist in Google Sheets

Click to buy Mortgage Checklist in Google Sheets

The template is structured to provide a comprehensive approach to mortgage management, making it easier to track tasks, responsibilities, and deadlines. Below are the key features:

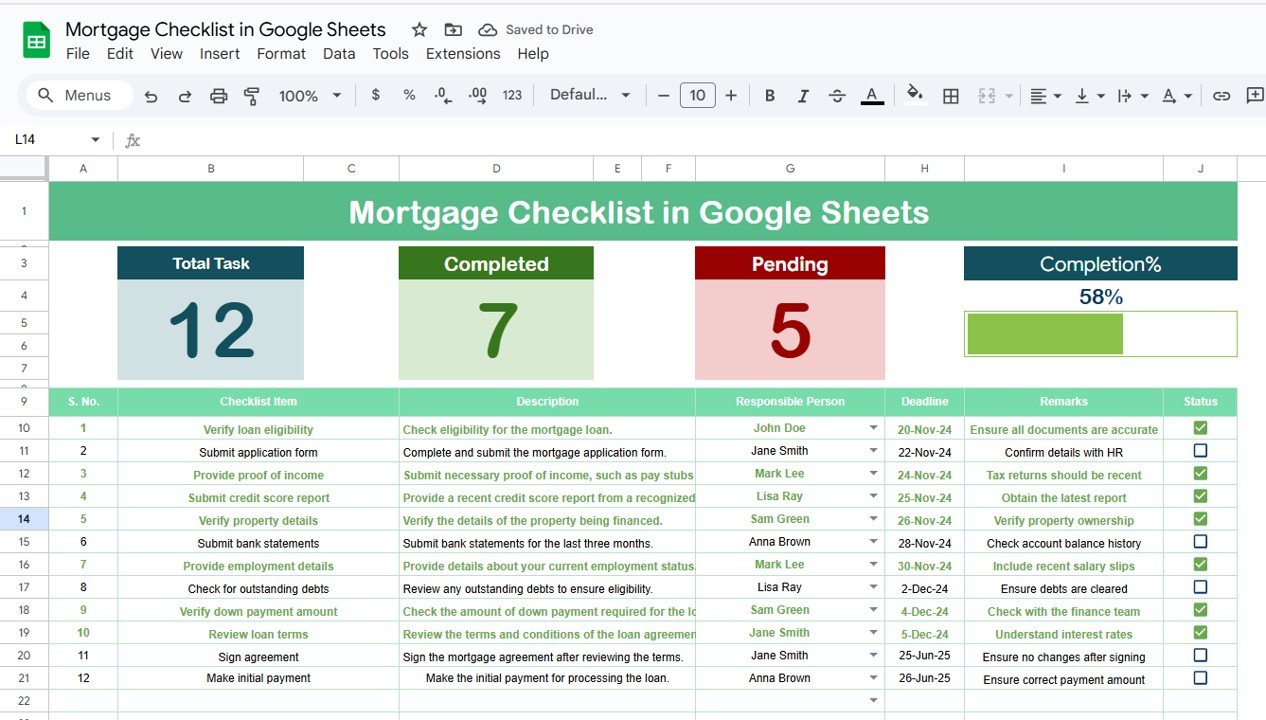

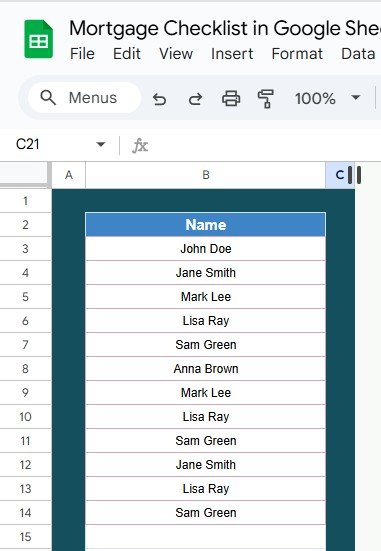

1. Mortgage Checklist Sheet Tab

The Mortgage Checklist Sheet is where you’ll track your tasks and their statuses. The main features include:

Top Section:

Cards Display: The top section includes three cards to help you quickly assess your progress:

- Total Count: Displays the total number of tasks you need to complete.

- Completed Count: Shows the number of tasks that have been completed.

- Pending Count: Displays how many tasks are still pending.

- Progress Bar: Provides a visual representation of your overall progress based on completed tasks.

Checklist Table:

The main part of the sheet is the Checklist Table, where you will input the details of each mortgage-related task. The columns in this table include:

- Serial No.: A unique identifier for each task.

- Checklist Item: The name of the task (e.g., “Submit income verification documents”).

- Description: Any additional details or instructions related to the task.

- Responsible Person: The individual or team responsible for completing the task.

- Deadline: The date by which the task should be completed.

- Remarks: Any notes or additional information about the task.

- Status: A checkbox where you mark the task as ✔ (completed) or ✘ (pending), allowing you to track which tasks are done.

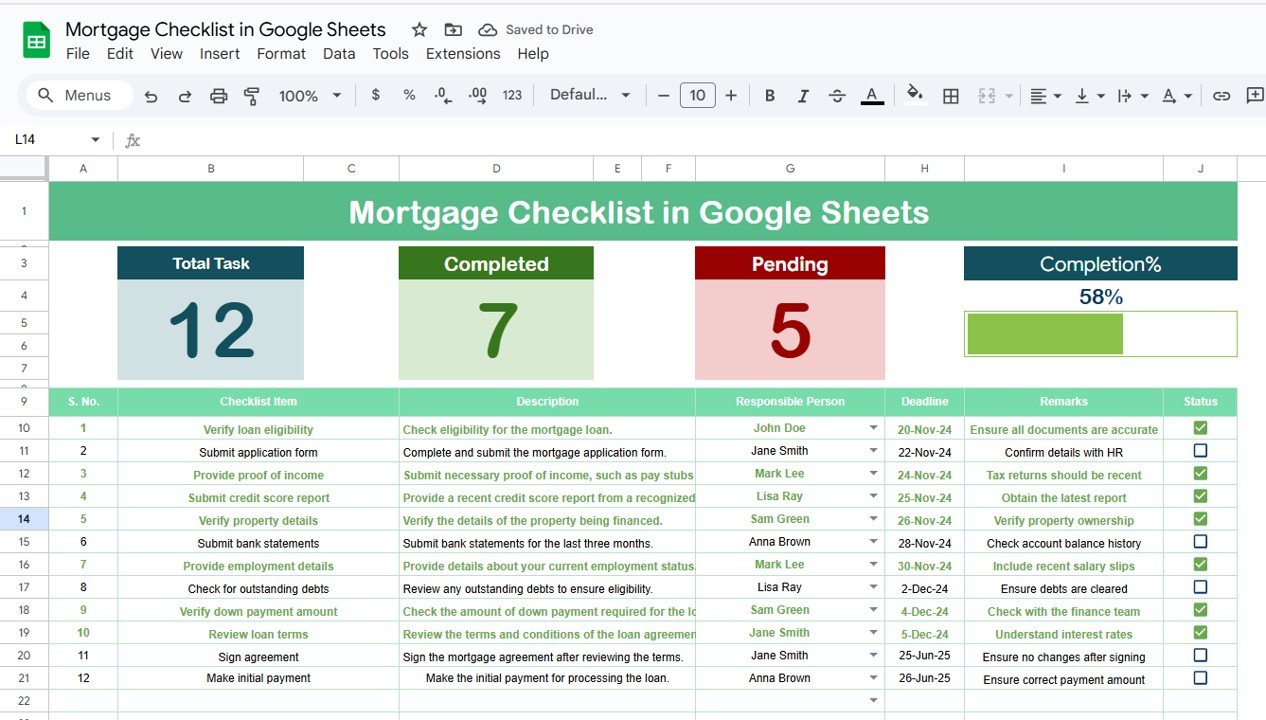

2. List Sheet Tab

Click to buy Mortgage Checklist in Google Sheets

The List Sheet is used to capture a list of Responsible Persons for each task. This sheet helps you create a dropdown list in the Mortgage Checklist Sheet, ensuring that the correct individual or team is assigned to each task.

-

Responsible Person Dropdown:

In the List Sheet, you will list the names of individuals or teams responsible for completing the tasks. This list is then used in the Mortgage Checklist Sheet to assign tasks effectively.

-

List Sheet Tab

Advantages of Using the Mortgage Checklist

-

Centralized Task Tracking:Keep all mortgage-related tasks in one place, making it easier to manage and track progress.

-

Real-Time Progress Updates:The Total Count, Completed Count, and Pending Count cards provide real-time insights into your task completion status.

-

Clear Accountability:The Responsible Person column ensures that each task is assigned to the correct individual or team, providing clear accountability.

-

Customizable for Your Needs:The template is customizable, allowing you to add or remove tasks, adjust descriptions, and modify deadlines as needed.

-

Visual Feedback:The Progress Bar and Status checkboxes provide clear visual feedback on your progress, helping you stay organized and on top of deadlines.

Best Practices for Using the Mortgage Checklist

Click to buy Mortgage Checklist in Google Sheets

-

Update the Checklist Regularly:Regularly add new tasks and update the status of ongoing ones. This ensures that the checklist is current and accurately reflects the state of your mortgage process.

-

Set Realistic Deadlines:Assign achievable deadlines for each task. This helps prioritize tasks and ensures that your mortgage application process runs smoothly.

-

Review Progress Frequently:Regularly review the Total Count, Completed Count, and Pending Count to gauge your progress and make sure you’re staying on track with your mortgage tasks.

-

Assign Tasks Appropriately:Use the Responsible Person dropdown to assign tasks to the correct individual or team. This ensures that each person is accountable for completing their designated tasks.

-

Leverage Remarks for Clarity:Use the Remarks column to include additional context or instructions for each task, making it easier for responsible individuals to understand what needs to be done.

Frequently Asked Questions (FAQs)

1. How do I update the Mortgage Checklist?

Simply enter or update the relevant information in the Mortgage Checklist Sheet, marking tasks as ✔ (completed) or ✘ (pending). The Progress Bar and Cards will update automatically.

2. Can I track multiple mortgage applications with this checklist?

Yes, the checklist can be customized to track multiple mortgage applications by adding new categories or modifying the layout.

3. How do I ensure deadlines are met for all tasks?

Set realistic deadlines for each task in the Deadline column and regularly review the Progress Bar and Pending Count to ensure tasks are completed on time.

4. Can I assign multiple people to a task?

The Responsible Person column currently supports one person per task, but you can easily modify the template to accommodate multiple responsible individuals by adding additional columns.

5. How can I share this checklist with others?

Since it’s built in Google Sheets, you can easily share the checklist with others and collaborate in real-time by providing access via email or a shareable link.

Conclusion

Click to buy Mortgage Checklist in Google Sheets

The Mortgage Checklist in Google Sheets is an essential tool for managing and tracking your mortgage-related tasks. By providing clear accountability, real-time progress updates, and visual feedback, this checklist ensures that you stay organized and on top of deadlines throughout the mortgage process. Whether you’re applying for a new mortgage or managing an existing one, this template helps you keep everything on track and ensure a smooth process from start to finish.

Visit our YouTube channel to learn step-by-step video tutorials

Youtube.com/@NeotechNavigators

Watch the step-by-step video Demo: