Every business needs a clear view of revenue, expenses, profits, and losses. However, many companies still rely on scattered spreadsheets, manual calculations, or outdated formats. This slows down decision-making and increases the risk of mistakes. Because of this, Profit and Loss Templates in Google Sheets have become extremely popular among small businesses, startups, freelancers, and finance professionals.

A Profit and Loss (P&L) Template helps you track revenue, cost of goods sold, operating expenses, interest, taxes, and net profit—automatically. When you update monthly values, Google Sheets recalculates totals, visualizes trends, and presents a complete financial picture.

In this article, we will explain everything about the ready-to-use Profit and Loss Template in Google Sheets, its structure, dashboard sections, charts, and the value it brings to your financial management workflow.

What Is a Profit and Loss Template in Google Sheets?

A Profit and Loss Template is a spreadsheet tool that helps you record and calculate:

-

Revenue

-

Cost of Goods Sold (COGS)

-

Operating Expenses

-

Earnings

-

Taxes

-

Profit after tax

The Google Sheets version is popular because:

This ready-to-use template simplifies financial reporting and gives business owners a clear understanding of monthly and yearly performance.

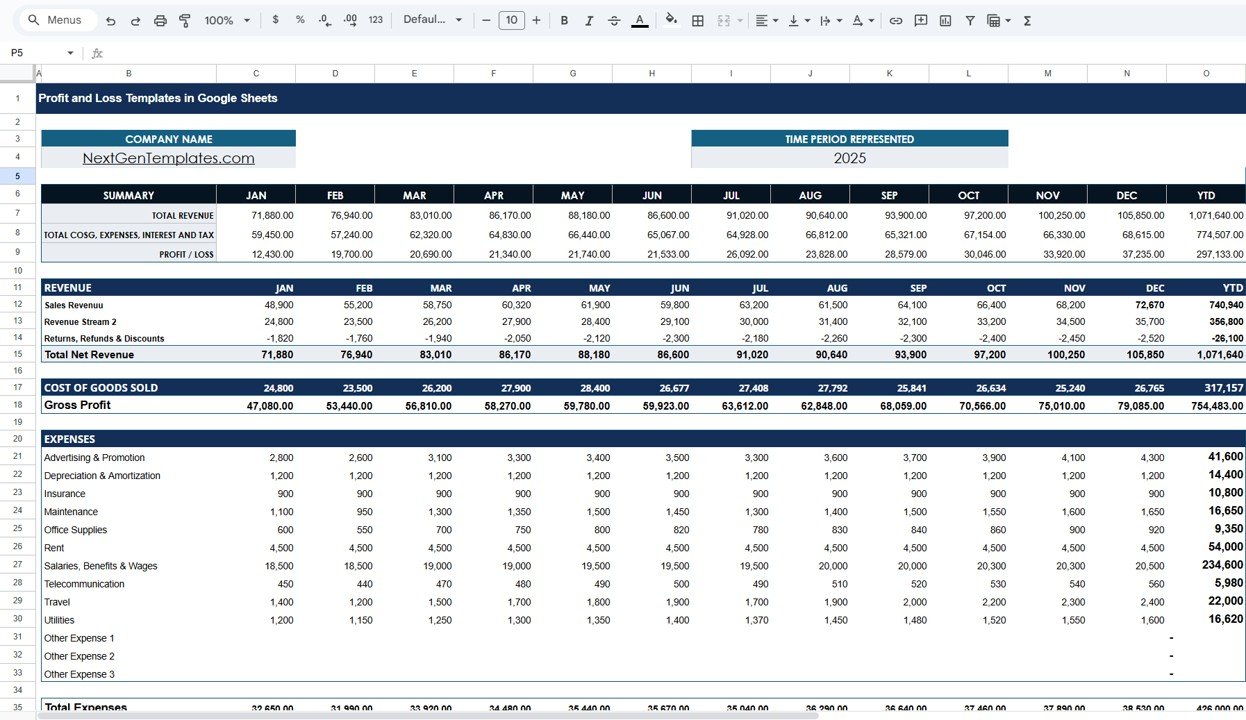

Template Sheet Tab – Complete Financial Table

Click to Buy Profit and Loss Templates in Google Sheets

The Template Sheet tab contains a full financial breakdown from January to December, including YTD totals.

Summary Section

-

Total Revenue

-

Total COGS, Expenses, Interest & Tax

-

Profit / Loss

Example from your template:

Revenue Section

This section breaks down all revenue types:

-

Sales Revenue

-

Revenue Stream 2

-

Returns, Refunds & Discounts

-

Total Net Revenue

The template automatically subtracts discounts and refunds.

Example YTD Summary:

Cost of Goods Sold (COGS)

The COGS section shows the direct cost required to produce goods.

The template calculates:

-

COGS: 317,157

-

Gross Profit: 754,483

Gross Profit becomes a key indicator of profitability before expenses.

Expenses Section

This section includes:

Advertising & Promotion

Depreciation & Amortization

Insurance

Maintenance

Office Supplies

Rent

Salaries & Benefits

Telecommunication

Travel

Utilities

Other Expenses

Example YTD Total Expenses: 426,000

The template calculates:

Earnings, Interest & Taxes

Structured fields include:

Earnings Before Interest & Taxes (EBIT)

Interest Expense

Profit Before Taxes

Income Taxes

Profit After Tax (Final Profit)

Click to Buy Profit and Loss Templates in Google Sheets

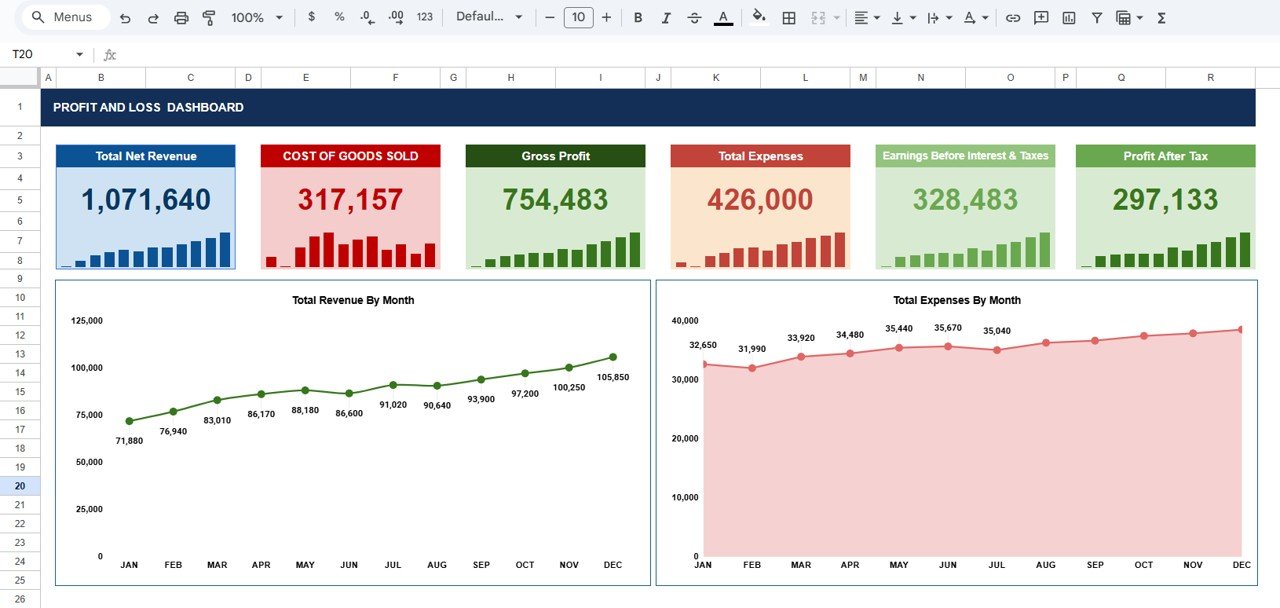

Dashboard Sheet Tab – Visual Financial Insights

The Dashboard provides a clean and interactive view of business performance. It includes financial cards and two key charts.

Dashboard Cards (KPIs)

Total Net Revenue

Shows total earnings after discounts.

Cost of Goods Sold

Displays direct cost needed to generate revenue.

Gross Profit

Indicates business profitability before expenses.

Total Expenses

Shows operational spending for the year.

Earnings Before Interest & Taxes (EBIT)

Measures operational efficiency.

Profit After Tax

Shows final profit remaining after all costs.

These cards help users understand financial performance instantly.

Dashboard Charts

The Dashboard includes two powerful charts:

Total Revenue by Month

This chart shows revenue trends across all 12 months.

It helps identify:

Seasonal peaks

Slow months

Revenue growth

Month-over-month improvement

Managers use this chart to plan sales strategies more effectively.

Total Expenses by Month

This chart visualizes monthly expenses.

It helps evaluate:

Spending spikes

Cost control

Budget planning

Operating efficiency

Together, these charts give a balanced overview of revenue vs. expenses.

Click to Buy Profit and Loss Templates in Google Sheets

Advantages of Using This Profit and Loss Template

Simple to Use

Anyone with basic spreadsheet knowledge can manage it.

Highly Customizable

Add new revenue or expense categories anytime.

Helps Identify Profit Trends

See which months perform best.

Supports Financial Planning

A clear P&L helps with forecasting and budgeting.

Enhances Operational Control

Track where money is spent and optimize cost centers.

Opportunities for Improvement

Click to Buy Profit and Loss Templates in Google Sheets

You can enhance the template with advanced features like:

Department-wise P&L

Track revenue and expenses by business unit.

Forecasting Models

Add 3-month or 12-month projections.

Automated Alerts

Highlight profit dips or high expenses.

Year-over-Year Comparison

Compare profitability across years.

Best Practices for Using Profit & Loss Templates

Update revenue and expenses monthly : Accurate numbers create accurate insights.

Categorize expenses consistently: Avoid naming variations like “Utilities” vs “Utility”.

Review Gross Profit every month: It helps track cost efficiency.

Compare Revenue vs Expenses: This ensures spending stays aligned with earnings.

Use charts for presentations: Visual insights help during management reviews.

Conclusion

Click to Buy Profit and Loss Templates in Google Sheets

A Profit and Loss Template in Google Sheets helps businesses track revenue, expenses, and profit with clarity and confidence. It offers automated calculations, insightful dashboards, and a simple layout that suits all business types. Whether you run a startup, a consultancy, a retail shop, or a large operation, this template ensures proper financial monitoring and smarter decision-making.

With a well-organized P&L structure and a clean dashboard, your business gains real-time visibility, better planning ability, and improved profitability management.

Frequently Asked Questions (FAQs)

1. Who should use this Profit and Loss Template?

Business owners, finance teams, startups, and freelancers.

2. Does it support real-time collaboration?

Yes, Google Sheets allows multi-user access.

3. Can I add more expense categories?

Yes, the template is fully customizable.

4. Does it calculate totals automatically?

Yes, all formulas are pre-built.

5. Is this template suitable for monthly reporting?

Absolutely—each month feeds into the YTD summary.

6. Do I need accounting knowledge?

Basic understanding is enough.

Watch the step-by-step video tutorial:

Visit our YouTube channel to learn step-by-step video tutorials